50

BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

ANNUAL REPORT 2013

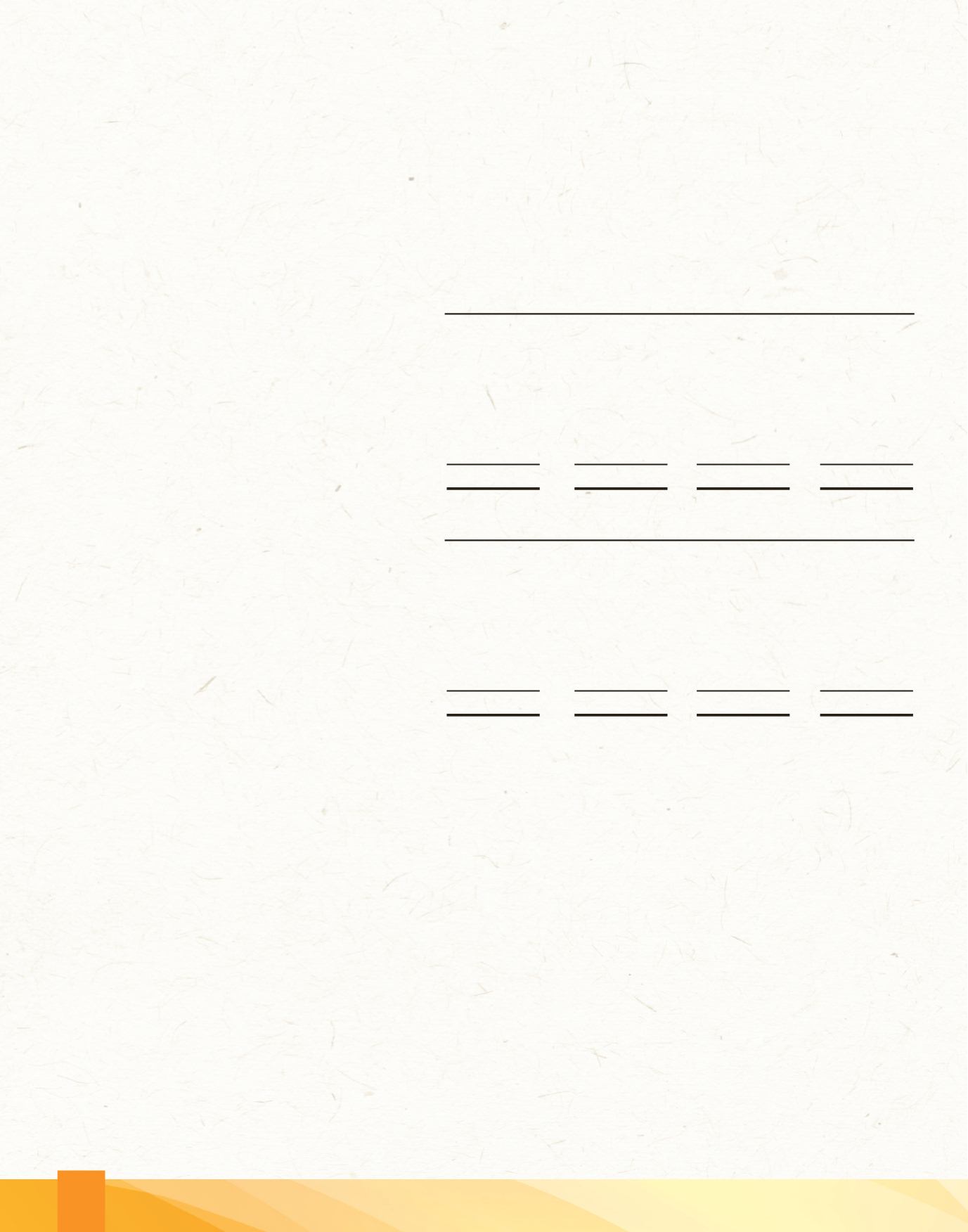

26. FAIR VALUE (CONTINUED)

For financial assets and financial liabilities that are liquid or have short term maturity, it is assumed that the carrying amounts

approximate their fair value. These include cash resources, other assets and liabilities. The fair value of debt securities is based on

quoted prices where available, or otherwise based on an appropriate yield curve with the same remaining term to maturity. The fair

value of loans and advances largely approximates carrying value as the Group’s portfolio comprises mainly variable rate loans. The fair

value of deposits takes account of certain fixed rate deposits which have been discounted at current interest rates.

The fair values of financial assets and liabilities, together with the carrying amounts shown in the statement of financial position are

shown in the below table:

2013

2012

Carrying

Carrying

Amount

Fair Value

Amount

Fair Value

Cash resources

$ 117,433,453

117,433,453

102,900,958

102,900,958

Financial investments

21,694,747

21,726,048

17,870,327

17,825,317

Loans and advances

774,614,499

774,614,499

749,729,372

749,729,372

Other assets

5,017,755

5,017,755

3,901,623

3,901,623

$ 918,760,454

918,791,755

874,402,280

874,357,270

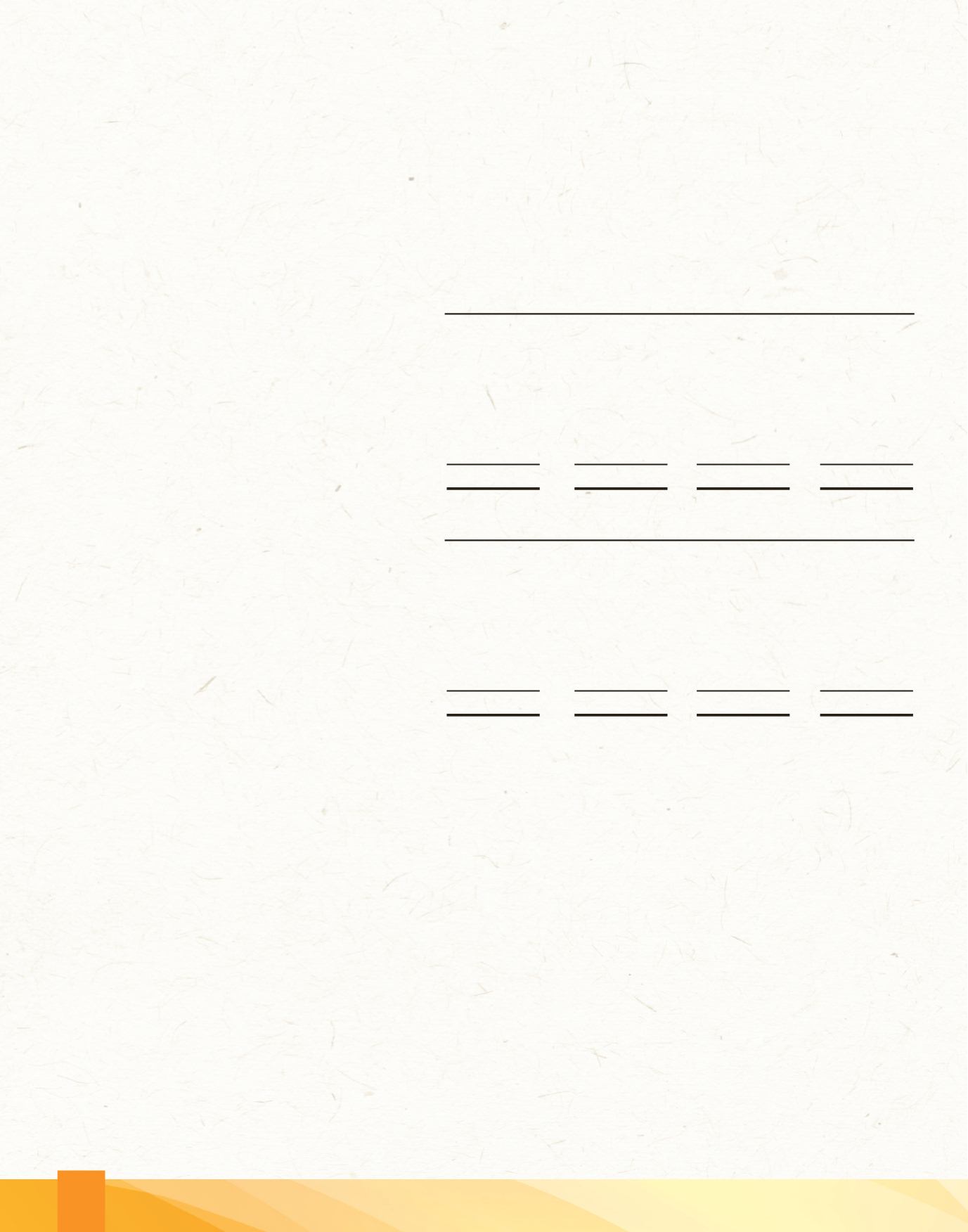

2013

2012

Carrying

Carrying

Amount

Fair Value

Amount

Fair Value

Deposits

$ 772,320,340

833,023,789

735,909,041

792,665,652

Loans payable

74,476,147

78,593,976

80,100,530

87,416,765

Reimbursable shares

5,726,048

5,726,048

4,532,147

4,532,147

Other liabilities

11,407,220

11,407,220

9,855,048

9,855,048

$ 863,929,755

928,751,033

830,396,766

894,469,612

Determination of fair value and fair value hierarchy

The Group uses the following hierarchy for determining and disclosing the fair value of financial instruments by valuation technique:

Level 1:

quoted (unadjusted) prices in active markets for identical assets or liabilities.

The fair value of financial instruments traded in active markets is based on quoted market prices at the statement of financial

position date. A market is regarded as active if quoted prices are readily and regularly available from an exchange, dealer, broker,

industry group, pricing service, or regulatory agency, and those prices represent actual and regularly occurring market transactions

on an arm’s length basis. The quoted market price used for financial assets held by the Group is the current bid price. These

instruments are included in level 1.

Level 2:

other techniques for which all inputs which have a significant effect on the recorded fair value are observable, either

directly or indirectly.

The fair value of financial instruments that are not traded in an active market (for example, over-the-counter derivatives) is

determined by using valuation techniques. These valuation techniques maximise the use of observable market data where it is

available and rely as little as possible on entity specific estimates. If all significant inputs required to fair value an instrument are

observable, the instrument is included in level 2.

Level 3:

techniques which use inputs which have a significant effect on the recorded fair value that are not based on observable

market data.

If one or more of the significant inputs is not based on observable market data, the instrument is included in level 3.

Notes to the Consolidated Financial Statements

For the year ended March 31, 2013, with comparative figures for 2012

(Expressed in Barbados dollars)