45

BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

ANNUAL REPORT 2013

Notes to the Consolidated Financial Statements

For the year ended March 31, 2013, with comparative figures for 2012

(Expressed in Barbados dollars)

The previous table represents the maximum credit risk exposure of the Group as of March 31, 2013 and March 31, 2012,

without taking account of any collateral held or other credit enhancements attached. For on-balance sheet assets, the exposures

set out above are based on net carrying amounts as reported in the balance sheet.

Credit quality by class of financial assets

Loans and advances

The credit quality of the loans and advances is managed through the prudent underwriting principles established by the Group.

Financial investments

The Group has principally invested in government bonds issued by the Government of Barbados which in the 2012 financial year

maintained a BBB rating by Standard & Poors. During the year ended March 31, 2013, this rating was downgraded to BB+.

Cash and balances with Central Bank

The credit quality of financial institutions holding the Group’s cash resources is assessed according to the level of their credit

worthiness and by comparison to other financial institutions. The Group places its cash resources with reputable financial

institutions.

The tables below show the credit quality and aging analysis by class of financial assets.

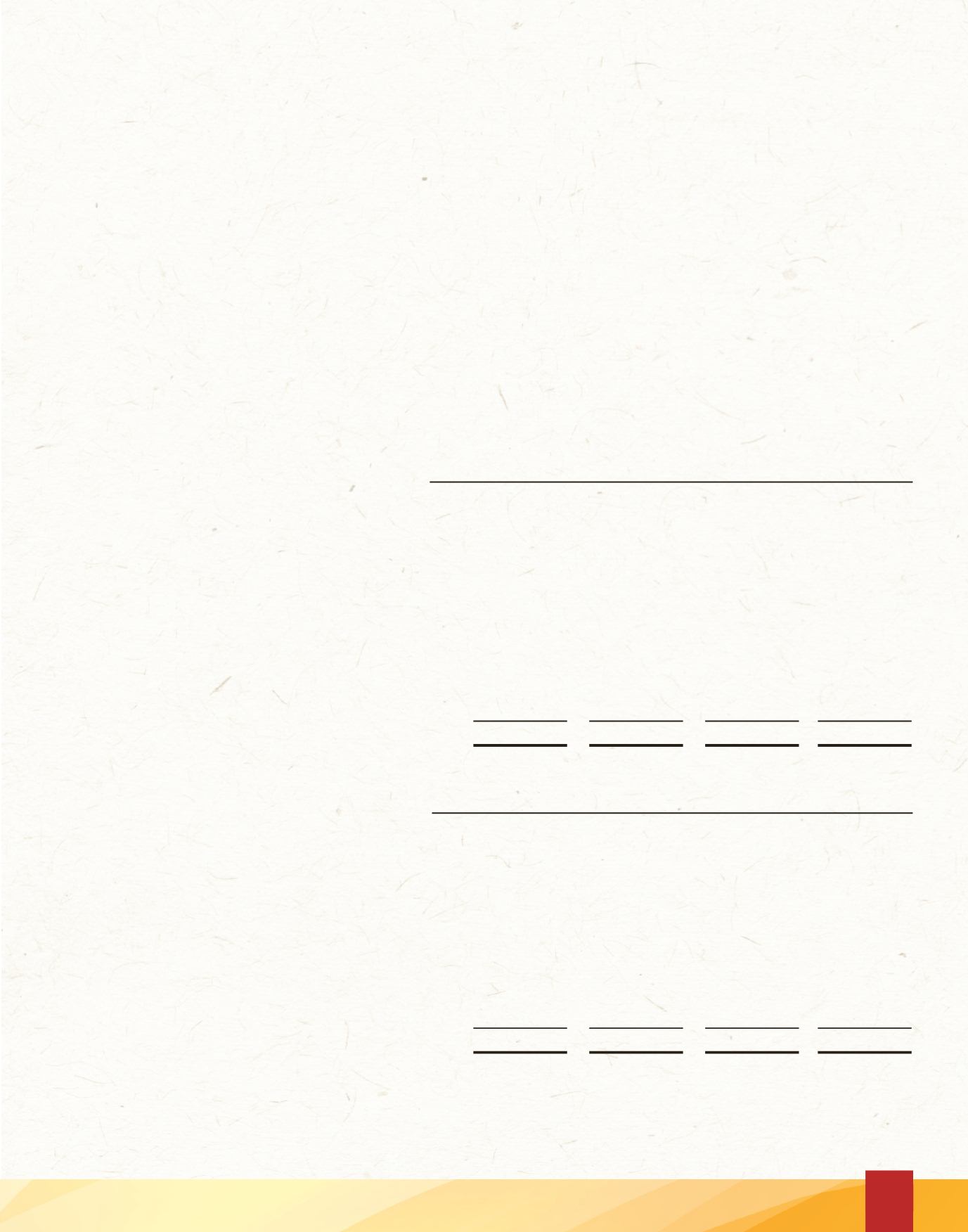

2013

Neither past due Past due but Individually

nor impaired not impaired

impaired

Total

Cash resources

$ 117,433,453

117,433,453

Financial investments:

Held to maturity

16,377,955

16,377,955

Loans and receivables

3,272,398

3,272,398

Loans and advances:

Consumer

382,784,145

61,810,349

33,642,427

478,236,921

Mortgages

245,912,283

33,457,415

25,171,083

304,540,781

Business

7,450,989

1,172,605

717,336

9,340,930

Total

$ 773,231,223

96,440,369

59,530,846

929,202,438

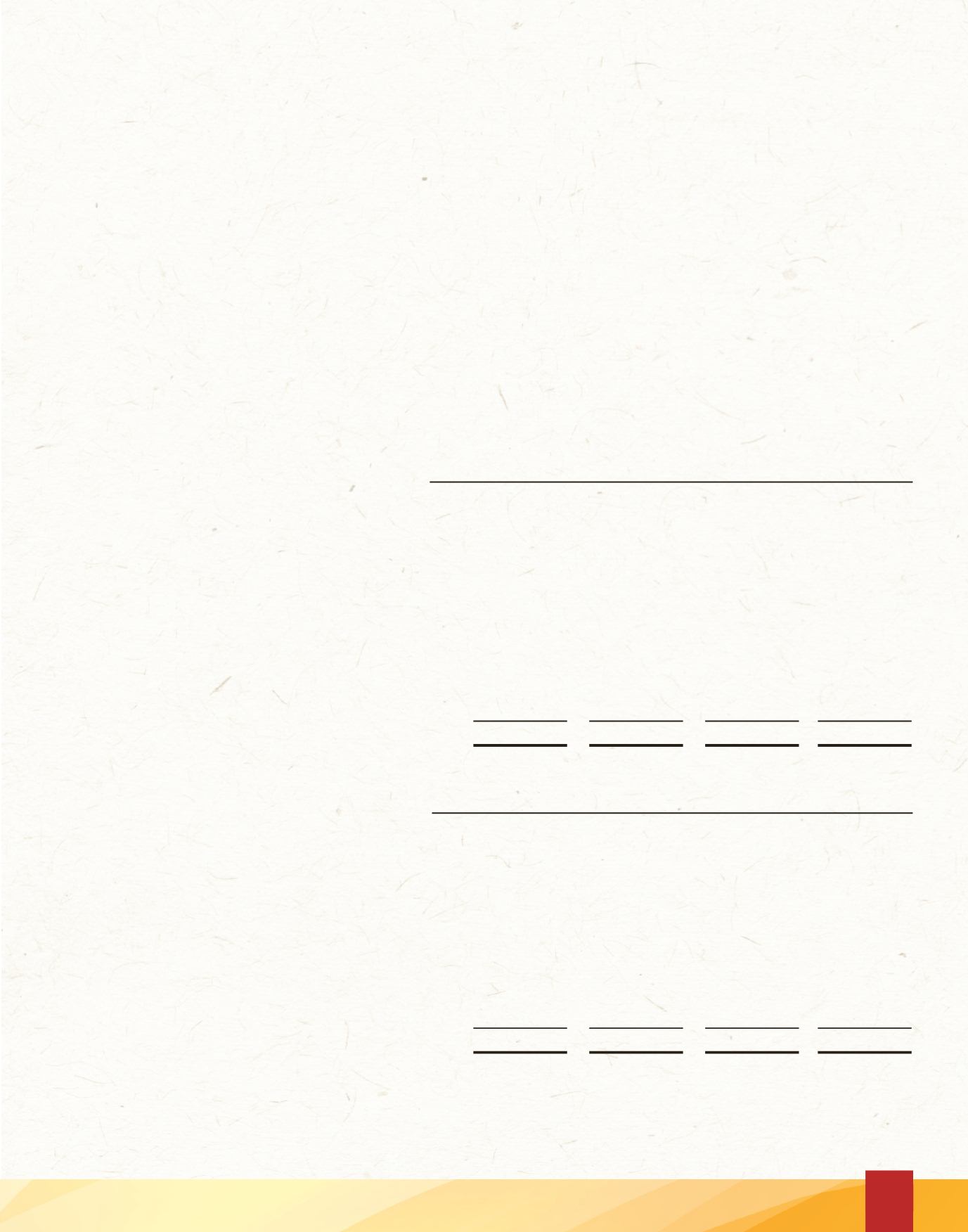

2012

Neither past due Past due but Individually

nor impaired not impaired

impaired

Total

Cash resources

$ 102,900,958

-

-

102,900,958

Financial investments:

Held to maturity

11,317,370

-

-

11,317,370

Loans and receivables

4,214,891

-

-

4,214,891

Loans and advances:

Consumer

371,172,652

57,952,465

30,198,768

459,323,885

Mortgages

249,427,223

35,976,670

16,263,261

301,667,154

Business

1,859,698

1,233,148

534,718

3,627,564

Total

$ 740,892,792

95,162,283

46,996,747

883,051,822

Within the Group, past due but not impaired loans represents loans which are in arrears between 1 to 180 days where the

specific details on those loans indicate recovery is not at issue.