49

BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

ANNUAL REPORT 2013

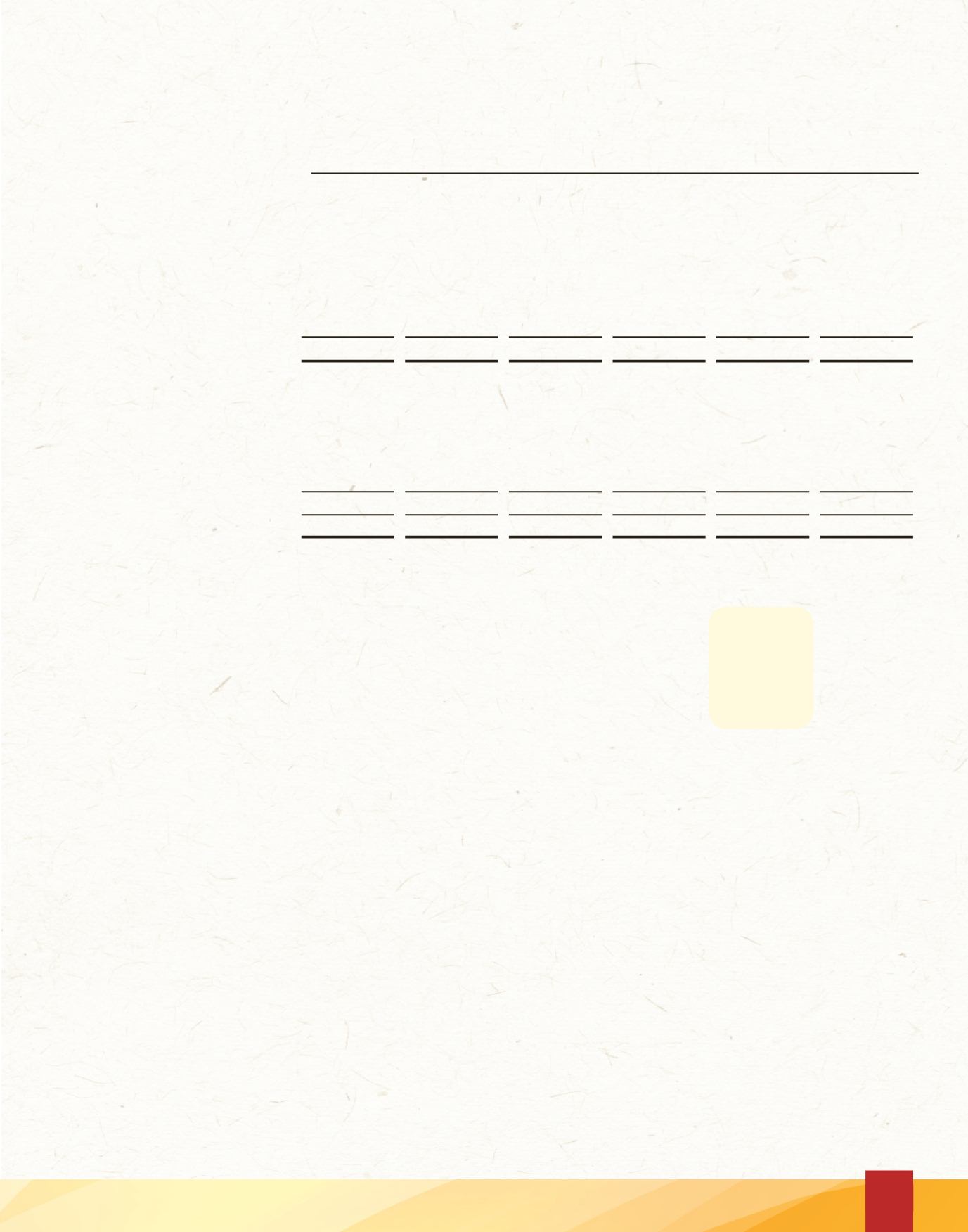

A summary of the Group’s interest rate gap position is as follows:

2012

Up to

Within

Within

Over Non-interest

3 months 3-12 months

1-5 years

5 years

bearing

Total

Assets

Cash resources

$ 51,344,213

46,430,916

-

-

5,125,829 102,900,958

Financial investments

64,891

2,208,370

12,609,000

650,000

-

15,532,261

Loans and advances

13,764,047

10,426,071 210,506,394 515,032,860

- 749,729,372

Other assets

-

-

-

-

3,901,623

3,901,623

Total assets

65,173,151

59,065,357 223,115,394 515,682,860

9,027,452 872,064,214

Liabilities

Deposits

426,241,305 116,279,199 163,403,092

29,985,445

- 735,909,041

Loans payable

1,044,467

3,194,556

19,551,423

56,310,084

-

80,100,530

Reimbursable shares

-

-

-

-

4,532,147

4,532,147

Other liabilities

-

-

-

-

9,855,048

9,855,048

Total liabilities

427,285,772 119,473,755 182,954,515

86,295,529

14,387,195 830,396,766

Interest rate gap

$(362,112,621) (60,408,398) 40,160,879 429,387,331

(5,359,743)

41,667,448

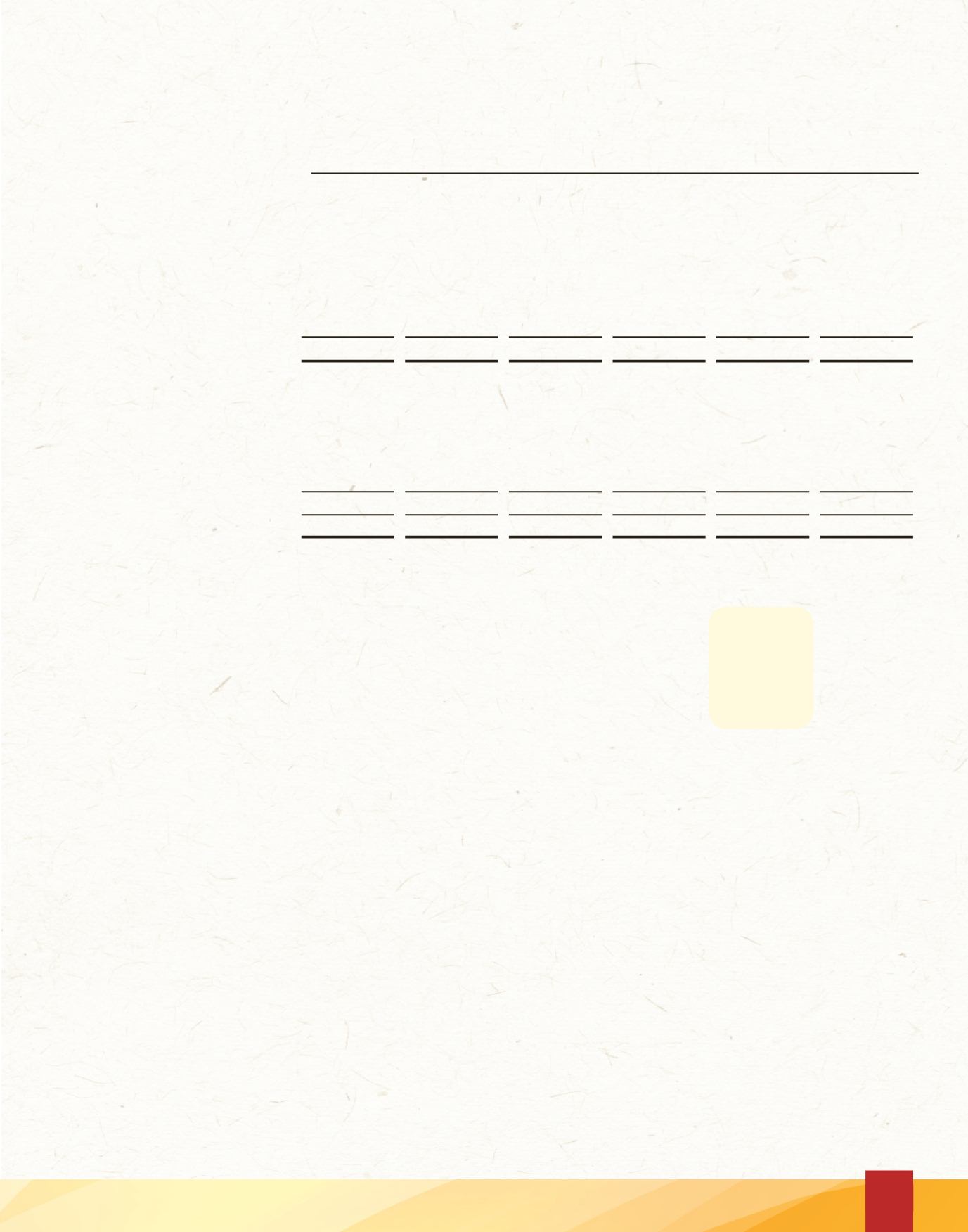

An interest rate sensitivity analysis was performed to determine the impact on profit of reasonable possible changes in the

interest rates prevailing as at March 31, 2013, with all other variables held constant.

The impact is illustrated and shown in the table below:

2013

2012

Increase / decrease of 100 bps

Impact on profit + 100 bps

$ 3,022,227

1,142,507

Impact on profit – 100 bps

(3,022,227)

(1,136,960)

25.5Operational risk

Operational risk is the risk of direct or indirect loss arising from a wide variety of causes associated with the Group’s

processes, personnel, technology and infrastructure, and from external factors other than credit, market and liquidity risks

such as those arising from legal and regulatory requirements and generally accepted standards of corporate behaviour.

While operational risk is inherent to each of the Group’s business activities, the exposure is minimised by ensuring that

the appropriate infrastructure, controls, systems and human resources are in place. Key policies and procedures, used in

managing operating risk involve a strong internal audit function, segregation of duties, delegation of authority, and financial

and managerial reporting.

Within the Group, mitigation of operating risk is assigned to senior management supported by a well-defined organisational

structure that segregates operational and administrative functions. Back-up capabilities are also maintained to ensure on-

going service delivery in adverse circumstances.

In addition periodic reviews are undertaken by the Internal Audit department. The results of the reviews are discussed with

the management of the business unit to which they relate, senior management and the Board of Directors.

26. FAIR VALUE

Fair value represents the amounts at which a financial instrument could be exchanged in an arm’s length transaction between willing

parties and is best evidenced by a quoted market price, if one exists.

Financial assets and liabilities are carried at amounts, which approximate to their fair value at the statement of financial position date.

Fair value estimates are made at a specific point in time, based on market conditions and information about the financial instrument.

These estimates are subjective in nature and involve uncertainties and matters of significant judgment and therefore, cannot be

determined with precision. Changes in assumptions could significantly affect the estimates.

Notes to the Consolidated Financial Statements

For the year ended March 31, 2013, with comparative figures for 2012

(Expressed in Barbados dollars)