46

BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

ANNUAL REPORT 2013

Notes to the Consolidated Financial Statements

For the year ended March 31, 2013, with comparative figures for 2012

(Expressed in Barbados dollars)

25. FINANCIAL RISK MANAGEMENT (CONTINUED)

25.2Credit risk

(continued)

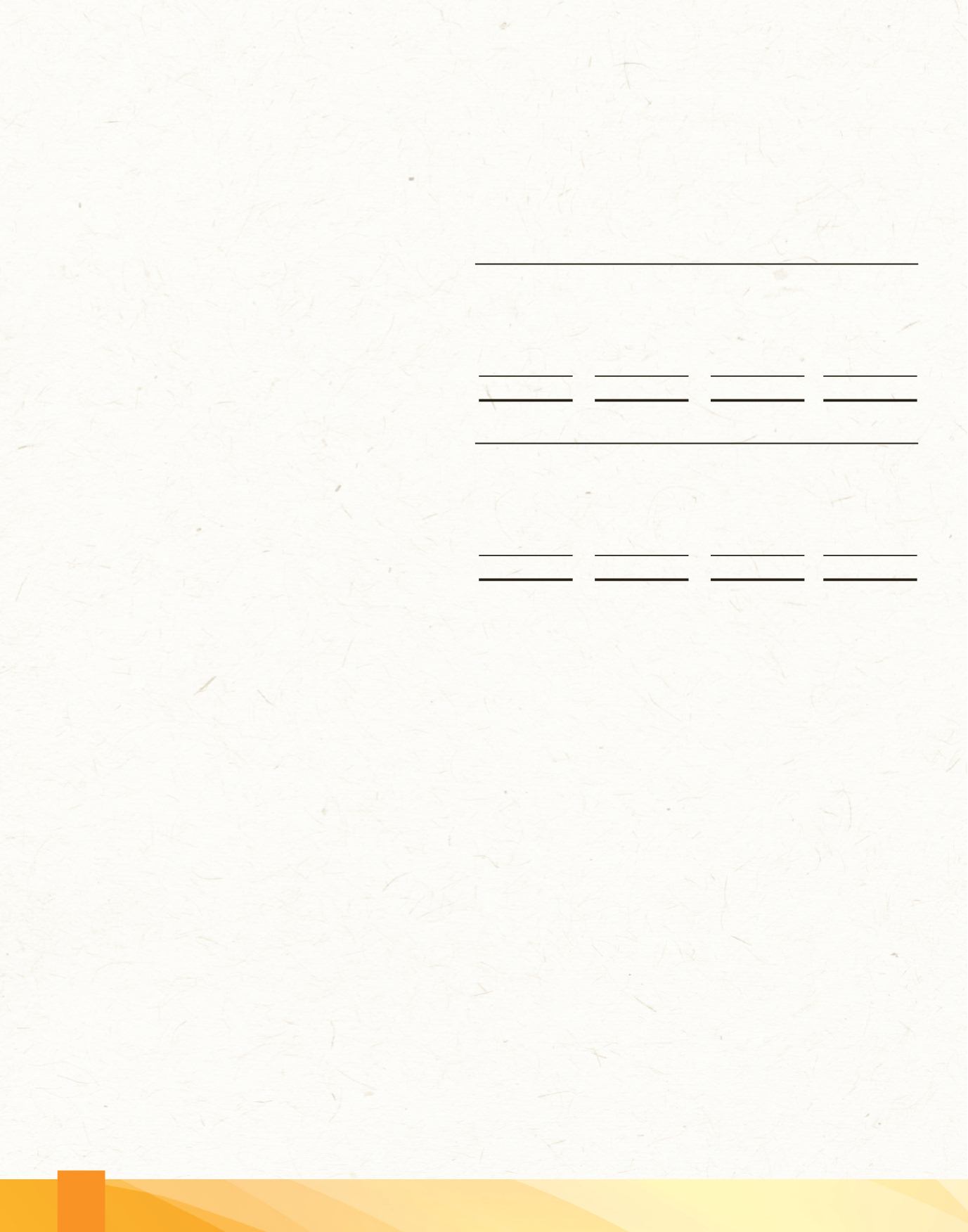

Aging analysis of past due but not impaired loans and advances:

2013

1-30 days

31-60 days

61-90 days

Total

Loans and advances:

Consumer

$ 46,331,063

11,238,111

4,241,175

61,810,349

Mortgage

22,911,341

6,982,495

3,563,579

33,457,415

Business

243,939

334,209

594,457

1,172,605

Total

$ 69,486,343

18,554,815

8,399,211

96,440,369

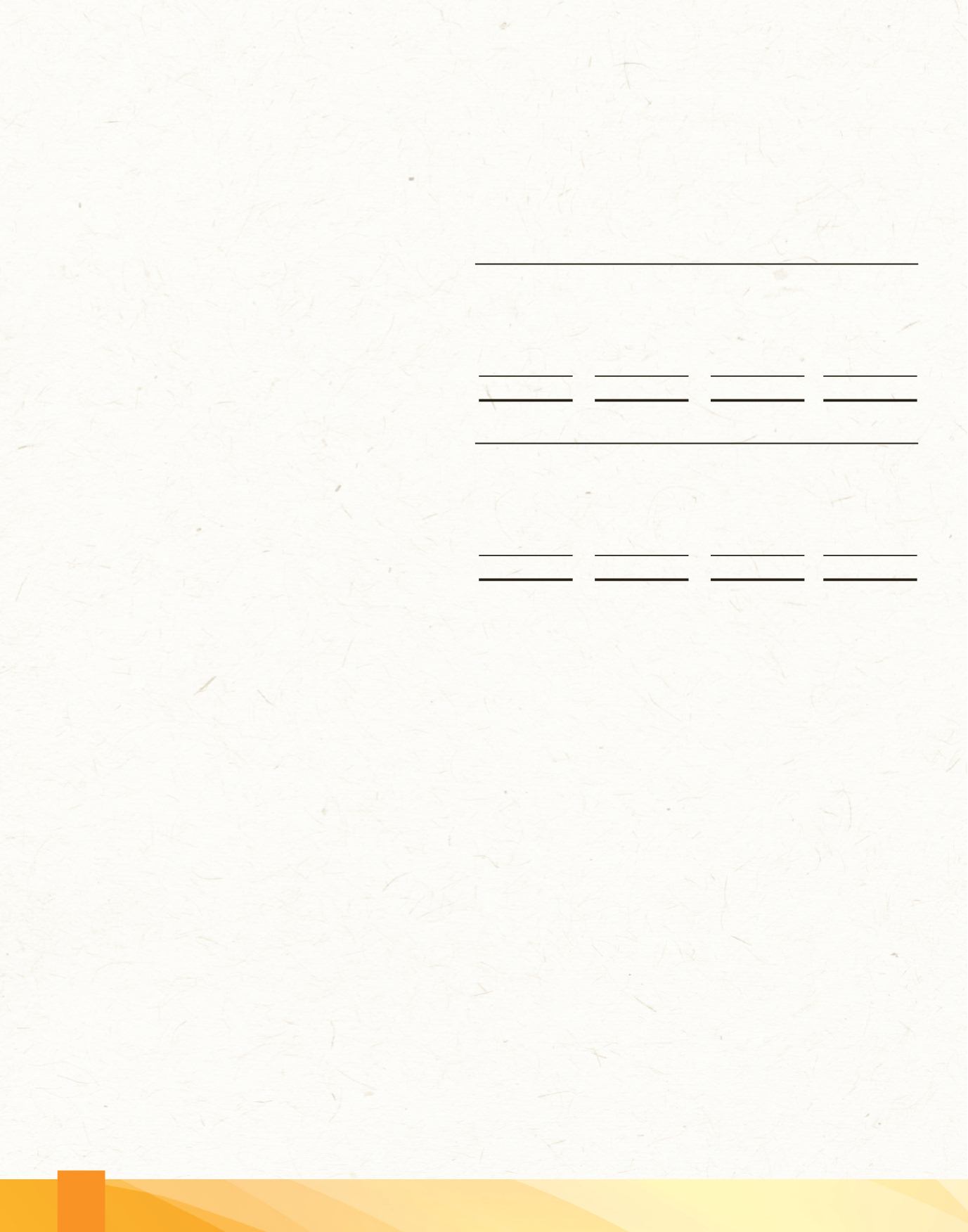

2012

1-30 days

31-60 days

61-90 days

Total

Loans and advances:

Consumer

$ 40,878,208

12,078,325

4,995,932

57,952,465

Mortgage

22,017,540

5,778,200

8,180,930

35,976,670

Business

913,394

185,871

133,883

1,233,148

Total

$ 63,809,142

18,042,396

13,310,745

95,162,283

Impairment assessment

For accounting purposes, the Group uses an incurred loss model for the recognition of losses on impaired financial assets. This

means that losses can only be recognised when objective evidence of a specific loss event has been observed. Triggering events

include the following:

- Significant financial difficulty of the customer.

- A breach of contract such as a default of payment.

- Where the Group grants the customer a concession due to the customer experiencing financial difficulty.

- It becomes probable that the customer will enter bankruptcy or other financial reorganisation.

- Observable data that suggests that there is a decrease in the estimated future cash flows from the loans.

Individually assessed allowances

The Group determines the allowances appropriate for each individually significant loan or advance on an individual basis,

including any overdue payments of interest or infringement of the original terms of the contract. Items considered when

determining allowance amounts include the sustainability of the counterparty’s business plan, its ability to improve performance

once a financial difficulty has arisen, projected receipts and the expected payout should bankruptcy ensue, the availability of

other financial support, the realisable value of collateral and the timing of the expected cash flows. Impairment allowances are

evaluated at each reporting date, unless unforeseen circumstances require more careful attention.

Collectively assessed allowances

Impairment allowances are assessed collectively for losses on loans and advances, held-to-maturity debt investments and loans

and receivable investments that are not individually significant and for individually significant loans and advances that have

been assessed individually and found not to be impaired.

The Group generally bases its analyses on historical experience. However, when there are significant market developments, the

Group would include macroeconomic factors within its assessments. These factors include, depending on the characteristics

of the individual or collective assessment: unemployment rates, current levels of bad debts, changes in laws, changes in

regulations, bankruptcy trends, and other consumer data. The Group may use the aforementioned factors as appropriate to

adjust the impairment allowances.