48

BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

ANNUAL REPORT 2013

25. FINANCIAL RISK MANAGEMENT (CONTINUED)

25.3Liquidity risk and funding management

(continued)

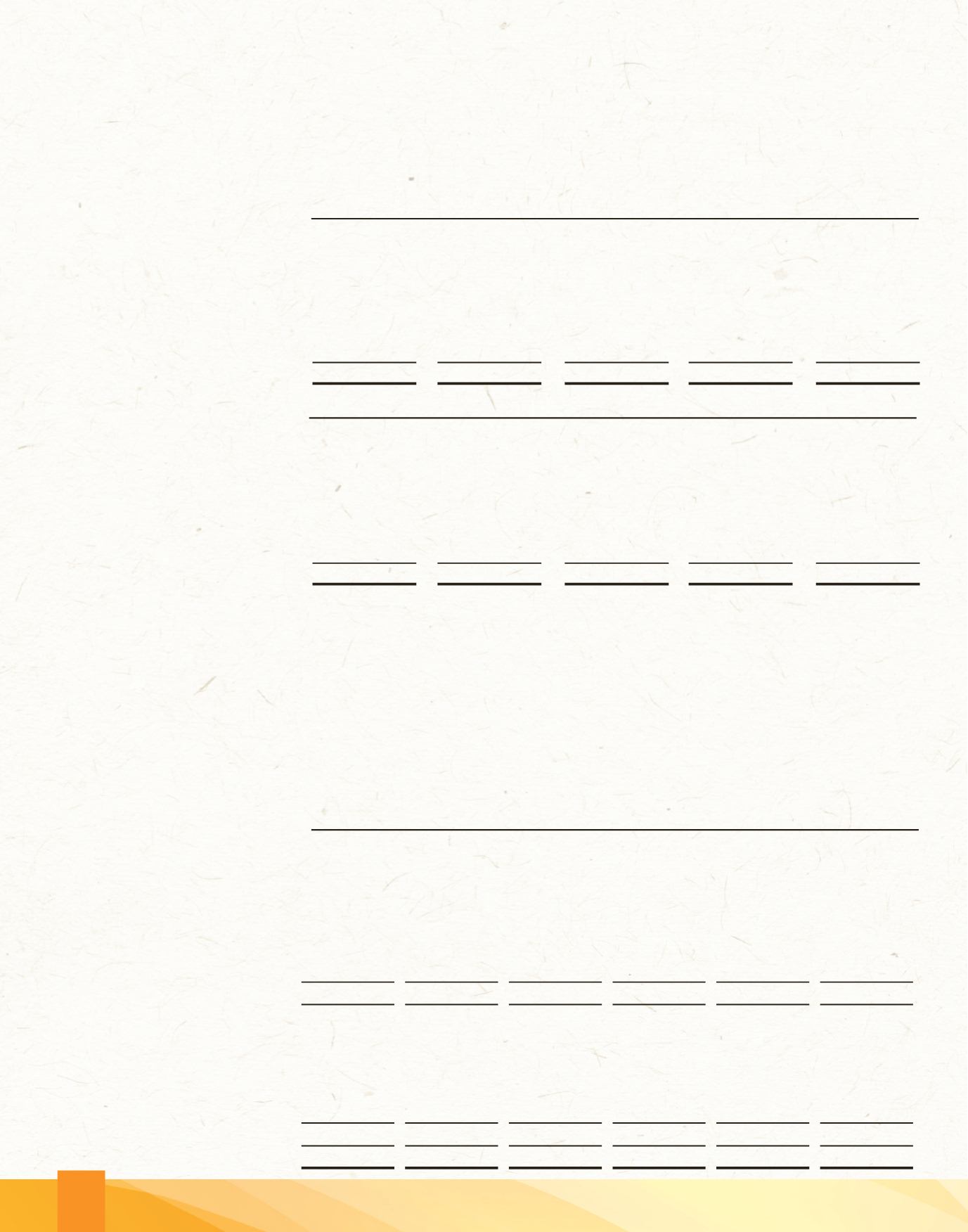

Liquidity Risk – Financial Liabilities

2013

Within

Within

Within

Over

3 months 3 -12 months

1-5 years

5 years

Total

Deposits

$ 484,641,716

83,533,054

220,471,268

50,616,346

839,262,384

Loans payable

1,929,909

5,705,827

30,172,129

67,940,810

105,748,675

Reimbursable shares

-

-

5,726,048

-

5,726,048

Other liabilities

6,712,026

4,695,194

-

-

11,407,220

$ 493,283,651

93,934,075

256,369,445

118,557,156

962,144,327

2012

Within

Within

Within

Over

3 months 3 -12 months

1-5 years

5 years

Total

Deposits

$ 449,589,730

118,311,730

181,188,233

48,288,895

797,378,588

Loans payable

1,930,215

5,764,217

30,846,419

77,844,602

116,385,453

Reimbursable shares

-

-

4,532,147

-

4,532,147

Other liabilities

4,128,889

5,726,159

-

-

9,855,048

$ 455,648,834

129,802,106

216,566,799

126,133,497

928,151,236

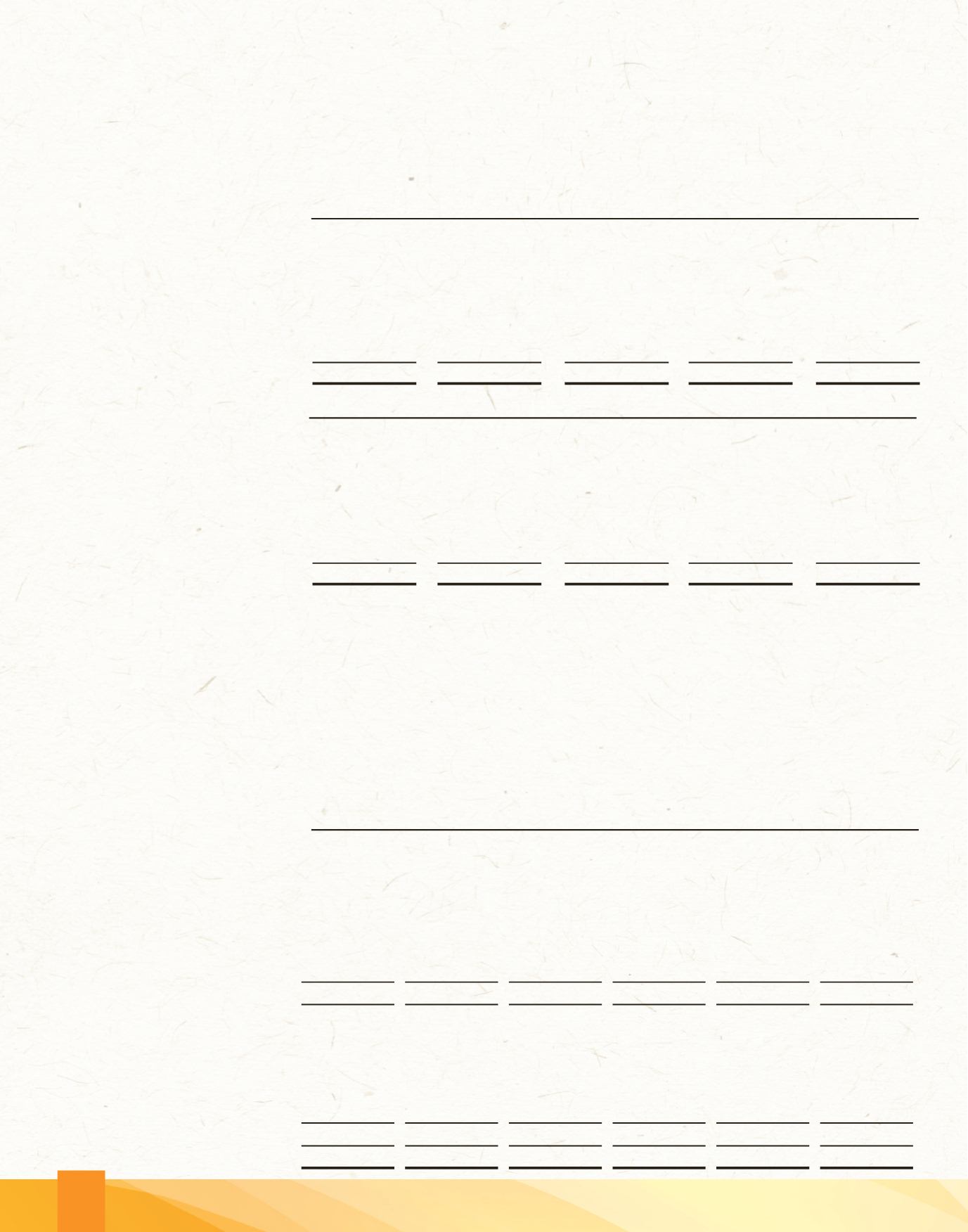

25.4Market risk

Market risk is the risk that the fair value or future cash flows of financial instruments will fluctuate due to changes in market

variables such as interest rates, foreign exchange rates and equity prices. The Group is mainly exposed to interest rate risk.

The Group’s exposure to currency risk is minimal as a result of the fixed rate of exchange between the Barbados and Eastern

Caribbean dollar.

Interest rate risk

Interest rate risk is the risk of loss from the fluctuations in the future cash flows or fair values of financial instruments because

of a change in market interest rates. It arises when there is a mismatch between interest-bearing assets and interest-bearing

liabilities, which are subject to interest rate adjustments, within a specified period. It can be reflected as a loss of future net

interest income and/or a loss of current market values.

A summary of the Group’s interest rate gap position is as follows:

2013

Up to

Within

Within

Over Non-interest

3 months 3-12 months

1-5 years

5 years

bearing

Total

Assets

Cash resources

$ 64,136,924

49,920,700

-

- 3,375,829 117,433,453

Financial investments

327,656

2,268,955

10,459,000

6,594,742

- 19,650,353

Loans and advances

14,075,514

21,067,420 209,831,569 529,639,996

- 774,614,499

Other assets

-

-

-

- 5,017,755

5,017,755

Total assets

78,540,094

73,257,075 220,290,569 536,234,738

8,393,584 916,716,060

Liabilities

Deposits

475,441,737

80,393,748 193,559,391

22,925,464

- 772,320,340

Loans payable

1,103,485

3,337,039

20,240,673

49,794,950

-

74,476,147

Reimbursable shares

-

-

-

- 5,726,048

5,726,048

Other liabilities

5,152,543

-

-

- 6,254,677

11,407,220

Total liabilities

481,697,765

83,730,787 213,800,064

72,720,414

11,980,725 863,929,755

Interest rate gap

$ (403,157,671) (10,473,712)

6,490,505 463,514,324

(3,587,141)

52,786,305

Notes to the Consolidated Financial Statements

For the year ended March 31, 2013, with comparative figures for 2012

(Expressed in Barbados dollars)