BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

CONSOLIDATED ANNUAL REPORT 2015

14

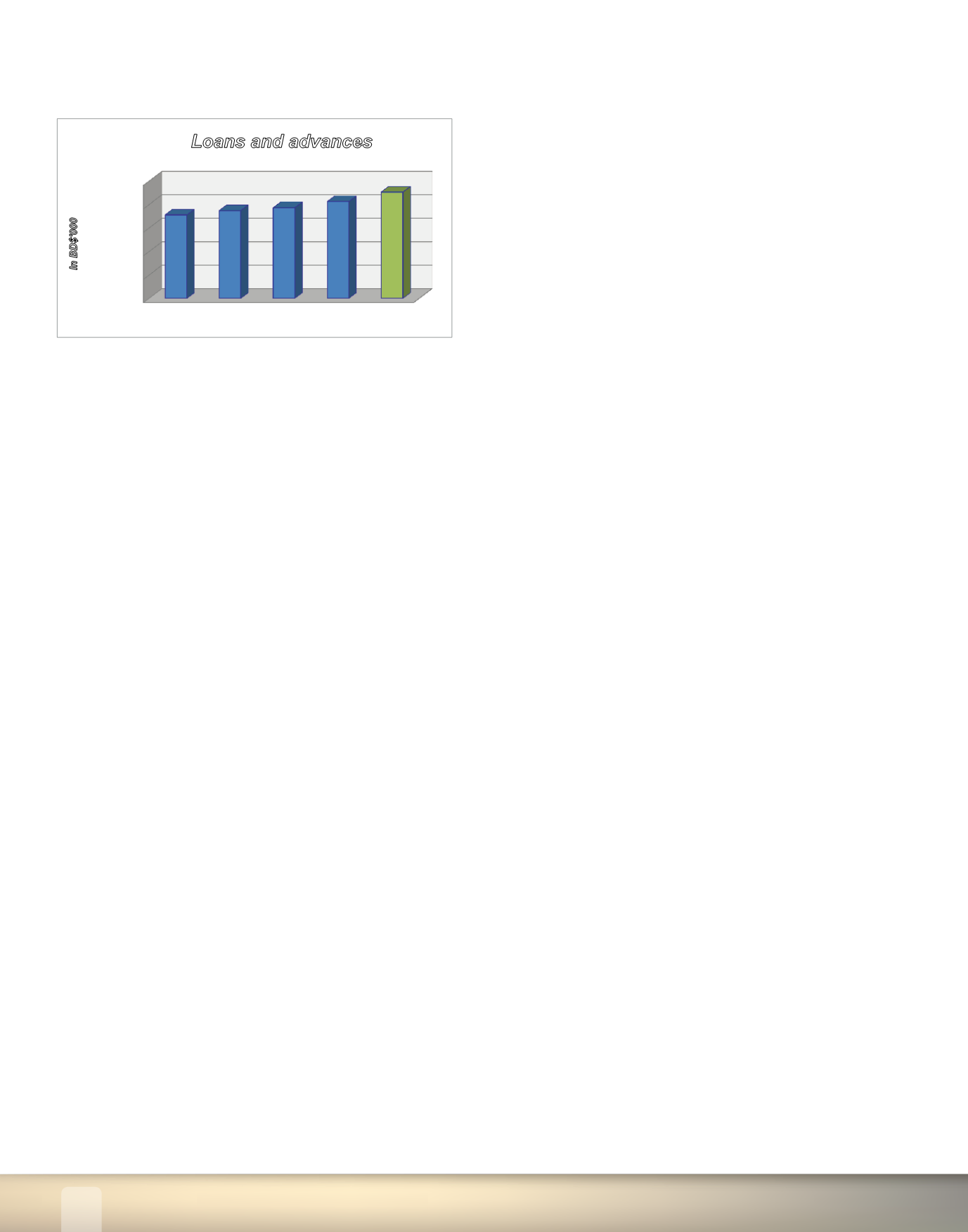

The Credit Union led the growth in the mortgage loan portfolio

which accounted for approximately $18.3 million in mortgages.

Consumer loans were the major instrument of loan growth at

the Credit Union accounting for $44.3 million of the portfolio

increase.

This increase resulted from a more targeted marketing approach,

innovative loan promotions and from continuous streamlining of

the loan approval and disbursement processes.

These initiatives enabled the sustainment of the increasing loan

trend realized across the Group.

The Group remained highly liquid with total cash resources

totaling $108.8 million. Financial investments increased by $5.3

million or 20.6 percent due largely to additional purchases of

government securities during the financial year.

Asset Quality

The delinquency ratio increased slightly from 6.7 percent in 2014

to 6.8 percent at March 31, 2015. This is commendable given

the current environment and is attributable to close monitoring

of delinquent accounts, creating payment solutions for members

who are experiencing challenges and strict adherence to credit

control and underwriting requirements.

The Group also maintained a consistent approach to the

provisioning process based on thorough reviews of individual

credits and analyses of collective portfolio risk characteristics.

A key focus of management in recent months has involved

working proactively with members and customers to offer

financial counseling and provide alternatives to current loan

arrangements with the aim of maintaining sound credit ratings

and risk profiles.

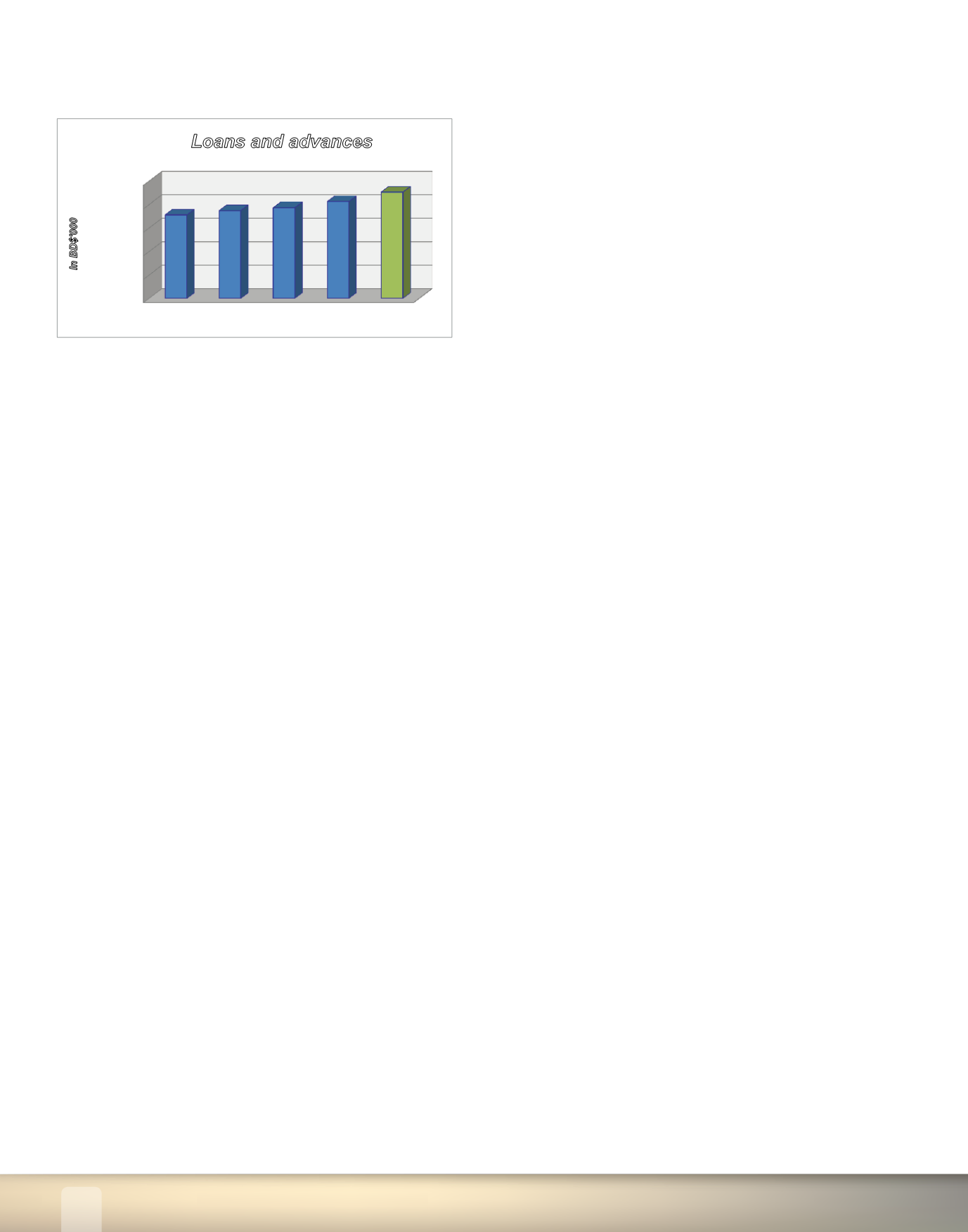

Liabilities

The Group’s strong liquidity position continued to be driven by

the growth in deposit liabilities. At the financial year end, the

Group’s deposits totaled $915.3 million, an increase of $76.3

million or 9.1 percent higher than at the previous year-end.

Deposits at the Credit Union grew by $53.3 million or 7.4 percent,

while Capita continued to reflect a steady increase in customer

deposits which increased by $23.1 million or 16.9 percent.

0

200000

400000

600000

800000

1000000

2011

2012

2013

2014

2015

712,623 749,729 774,615 825,149

906,060

In BD$'000

Loans and advances

0

200000

400000

600000

800000

1000000

2011

2012

2013

2014

2015

673,773

735,909 772,320

839,052

915,312

In BD$'000

Deposits

During the year under review the Credit Union repaid two high

interest rate loan facilities so as to reduce its debt service costs

and improve the overall net interest margin yield.

The Credit Union’s total loan repayment amounted to $10.2

million and was largely responsible for the reduction in loans

payable from $64.0 million at March 31, 2014 to $52.0 million

at March 31, 2015.

Equity

As at March 31, 2015, the Group’s total equity was $105.4

million, an increase of $8.8 million or 9.2 percent over the

previous year. The increase was primarily due to increased

profits of $10.3 million and growth in Credit Union share

capital of $0.5 million, net of dividend distributions of $2.0

million, paid to Credit Union members during the year.

The Group’s capital adequacy ratios are above minimum

capital requirements. These are continuously monitored when

assessing capital needs and evaluating changes in strategic

focus, risk tolerance levels, business plans and the operating

environment that might materially affect capital adequacy.

OUTLOOK – 2015 and Beyond

In the financial market, innovation is no longer incremental but

more exponential. The most remarkable advances have been

in the way in which products and services are delivered and

utilised.

These innovations are not driven by the financial industry, but

by technology pioneers such as Apple and Google. Thus as

mobile devices advance, so too do the applications for nearly

every industry, including finance.

In the past few months, we have seen major innovations in

mobile biometric security protocols and wearable devices, uses

which are already making their way into the banking sphere.

The key to our success is to position the Group to capitalize on

such innovations.

MANAGEMENT DISCUSSION AND ANALYSIS