13

BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

CONSOLIDATED ANNUAL REPORT 2015

Further, initiatives were undertaken during the year to leverage

Barbados’ advantage in international business and this is

expected to bear fruits in the near future.

The average unemployment rate stood at 12.5 percent, an

increase of 1.3 percent. Additionally, net public sector debt to

GDP was estimated at 73 percent compared to 67 percent a

year earlier.

Economic Outlook

Despite modest growth in 2014, the Central Bank projected

economic growth of 2 percent in 2015 and 2.3 percent in

2016.

This growth is expected to come from tourism and construction

activities which is expected to produce a spin-off effect in

wholesale, retail and business services.

Further, the Central Bank anticipates a reduction in the GDP’s

deficit by 5 percent once the new revenue measures are

implemented in 2015/2016 and current revenue measures are

extended.

Consolidated Financial Statement Highlights

Revenues

For the financial year ended March 31, 2015 the Group earned

total interest revenue of $80.9 million, up from $77.9 million

for the previous year. This represented an increase of $3.0

million or 3.9 percent for the year and is attributable to the

steady growth in both consumer and mortgage loans across

the Group.

Income generated from non-interest sources increased by

$284 thousand or 8.2 percent when compared with the

previous year, primarily as a result of increased efforts in bad

loan recoveries.

Net interest Income

Despite competitive pressures in lowering lending rates,

prudent management of the interest spread resulted in

consistent growth in net interest income during the year.

Net interest income grew by $1.0 million or 2.1 percent to

$49.8 million for the year, as a result of increased loan volumes

and a reduction in funding costs.

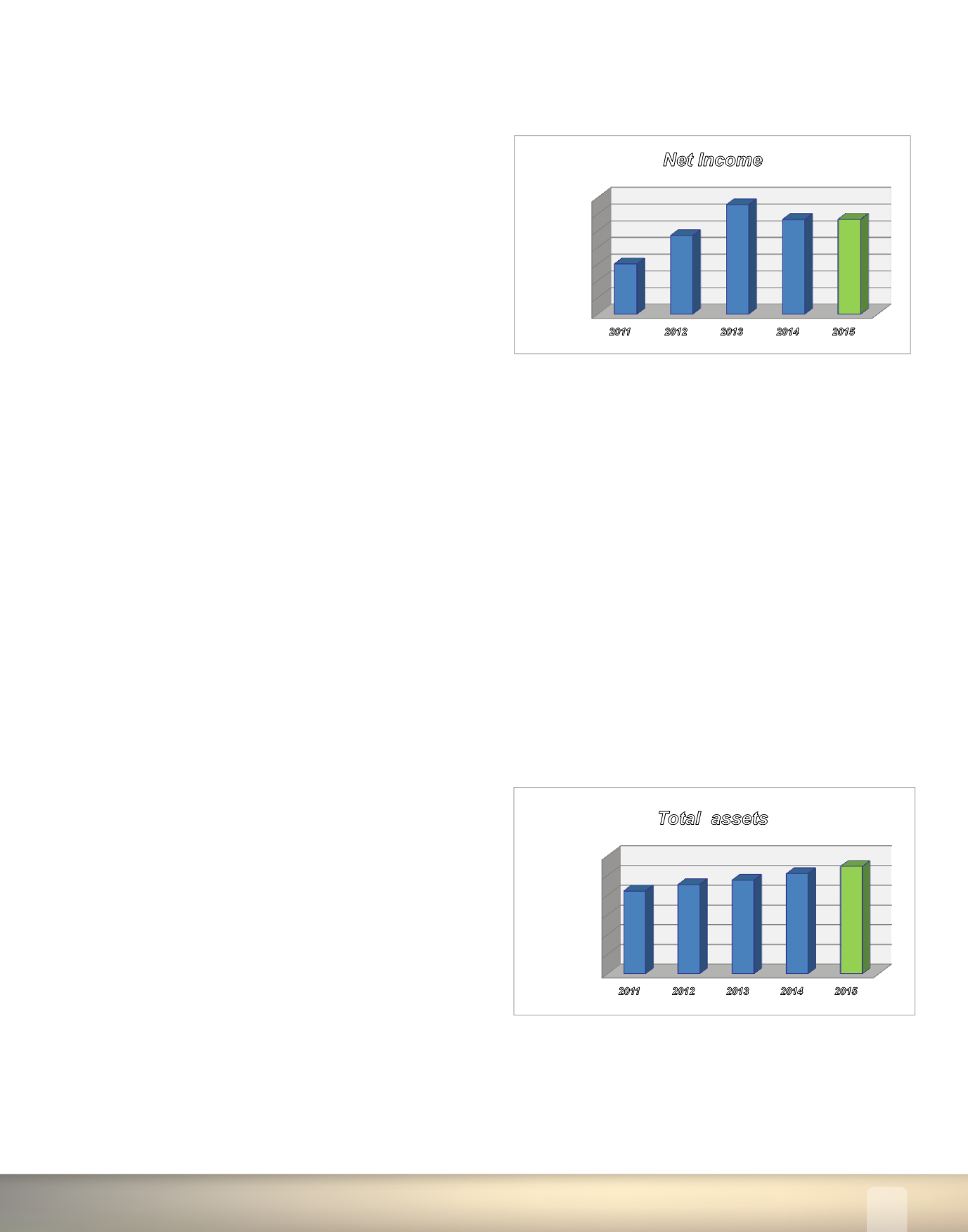

Net Income

The Group earned comprehensive income of $10.3 million

for the year ended March 31, 2015 compared with $10.8

million for the previous year. This represented a decline of

approximately $580 thousand or 5.4 percent under the prior

year.

Operating Expenses

Operating expenses increased from $36.1 million at March 31,

2014 to $39.8 million for 2015 and was driven principally by

the new tax on assets, increases in staff costs, rental expense

and security services.

The increase in staff costs amounted to $1.0 million and is due

to contractual salary increases and new hires in both the Credit

Union and Capita during the year.

The expansion of the Emerald City Branch, installation of two

additional ATMs and the rental of office space for staff of Capita

and the Credit Union during the year were responsible for the

notable increase in rental expense. A full year’s rent would have

been recorded during the year compared to a partial booking

in the last quarter of 2014. As a consequence, total rental costs

moved from $1.0 million in 2014 to $1.4 million for 2015.

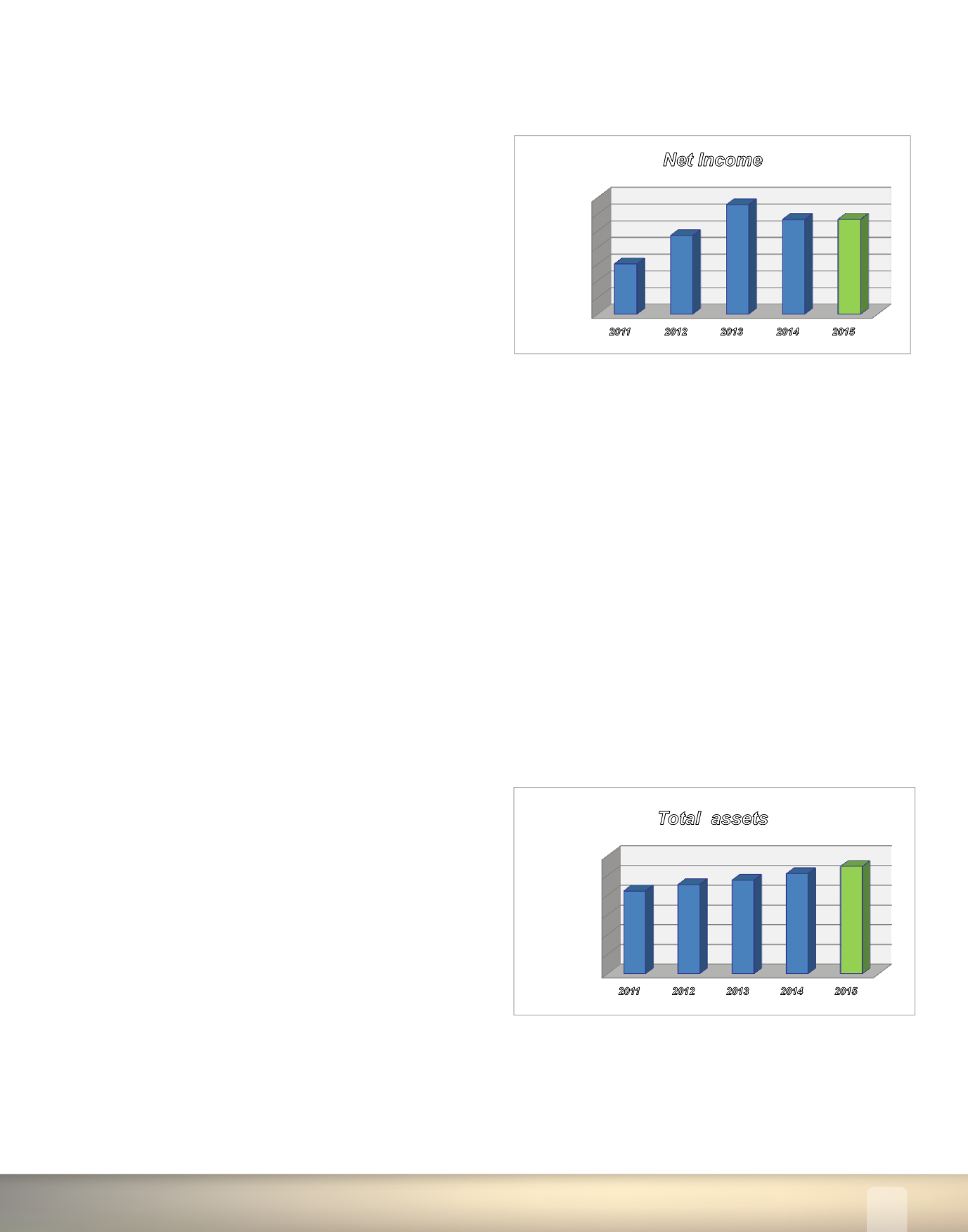

Assets

Total assets of the Group stood at $1.1 billion at March 31,

2015. This represented an increase of $73.6 million or 7.2

percent over the previous year.

At March 31, 2015, the Group’s consolidated net loans and

advances rose to $906.1 million, as compared to $825.1

million at the end of March 31, 2014. This represented an

overall increase of $80.9 million or 9.8 percent growth in loans

compared to an increase of $50.5 million one year ago.

0

200000

2011

2012

2013

2014

2015

In

0

2000

4000

6000

8000

10000

12000

14000

2011

2012

2013

2014

2015

6,052

9,424

13,126

11,347

11,381

In BD$'000

Net Income

MANAGEMENT DISCUSSION AND ANALYSIS

(continued)

0

200000

400000

600000

800000

1000000

1200000

2011

2012

2013

2014

2015

842,307 906,565 951,285 1,017,049

1,090,678

In BD$'000

Total assets

6000

8000

10000

12000

14000

6,052

9,424

13,126

11,347

11,381

In BD$'000

Net Income