BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

CONSOLIDATED ANNUAL REPORT 2015

8

OVERVIEW

The Board of Directors is happy to report another year’s

commendable performance notwithstanding the volatile

economic environment, and applauds management and staff

for their commitment and contribution to this achievement.

At March 31st, 2015 membership exceeded 70,000, and

based on our current growth path as a separate entity, the

Credit Union is on target to meet the one billion dollar mark in

assets during the coming year. These are significant milestones.

In the process of reviewing our past year’s performance, we

evaluated those things which impacted us in the pursuit of

achieving our strategic objectives, with a view to seeing how

these could either be improved or mitigated depending on the

impact.

In undertaking this exercise we sought to make a comparison

with the global Credit Union movement. The World Council of

Credit Unions in their 2013 report noted that, “In 2013, our

top challenges across the globe were more universal than ever

before. Large, small, emerging and mature systems, regardless

of their differences, all reported the same top challenges:

increased regulatory burden, payments innovation, young adult

membership growth and small credit union sustainability.”

These revelations almost perfectly mirror our domestic Credit

Union environment today.

As we seek to learn from our counterparts across the globe

to improve our individual operation and performance, we

must also examine those things that impact the movement as

a whole with a view to keeping Credit Unions alive and well

in Barbados. In evaluating each of these trends we remain

convicted in our efforts thus far and our vision for the future.

RAPIDLY CHANGING REGULATORY ENVIRONMENT

Today the Credit Union stands at a significant cross-road.

The new regulatory world, the dynamic technological future

and landscape, increased and intensified competition in the

financial services sector have all impacted on the operation of

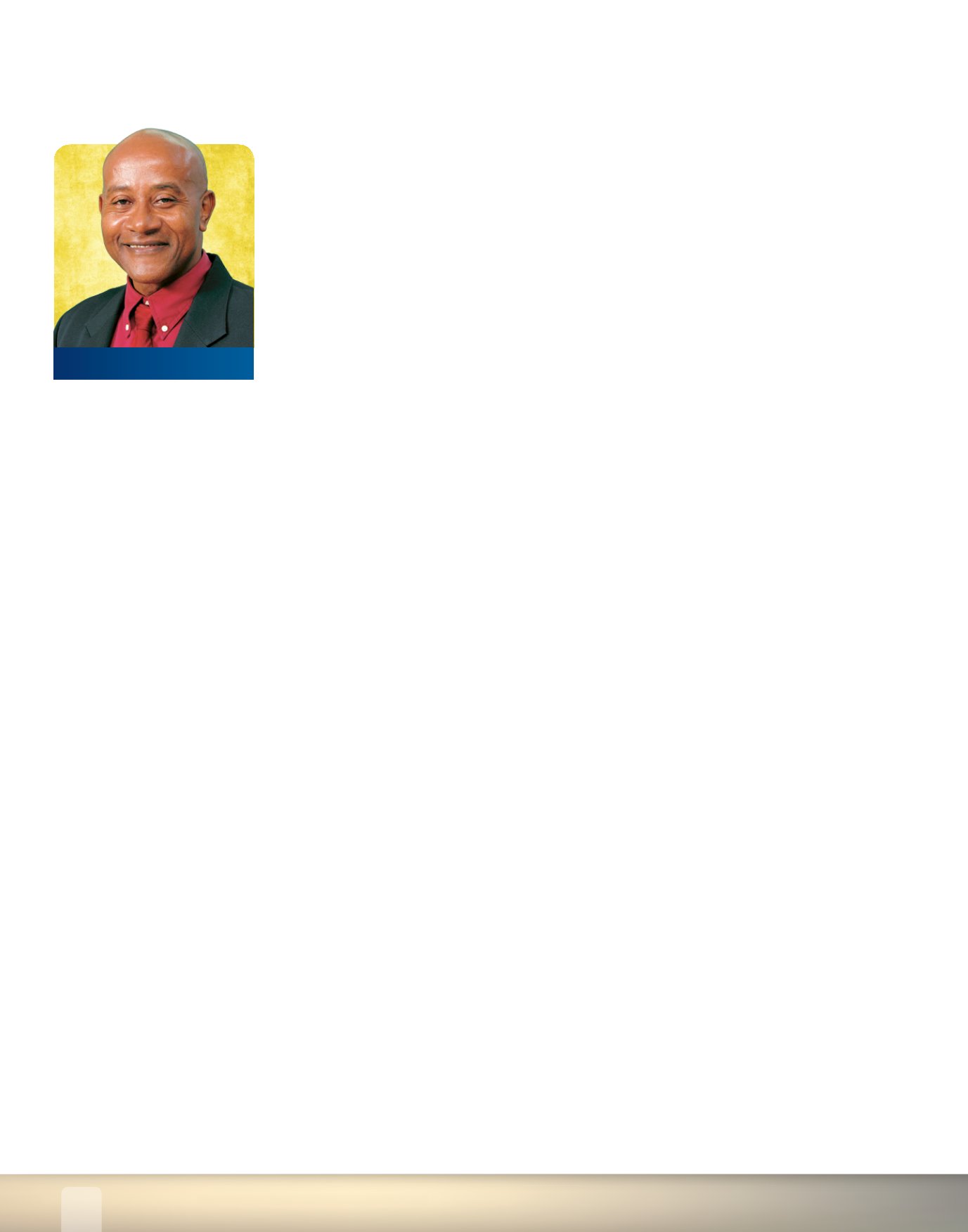

BOARD OF DIRECTORS’ REPORT

President

Bro. Glendon Belle

financial institutions, and more significantly on Credit Unions.

During the last financial year, we saw the implementation of

the asset tax on Credit Unions. While this was only imposed

on Credit Unions with assets of forty million dollars or more,

the impact was material as it is not our business model to pass

cost on through fees to our members as most other financial

institutions typically would. Through rigorous scenario

planning and budgeting exercises we were able to mitigate the

effects of this impact on our Credit Union.

Additionally, the introduction of the Foreign Asset Tax

Compliance Act (FATCA) and the reduction of the world to

a global village through technological advancements also

affected our operations this year. The implementation of FATCA

required changes to our internal operating procedures and

extensive training for operational staff which was championed

by our internal compliance team.

ACCESS TO SERVICES

The review of products and services is an ongoing process and

we must continue to be informed by diligent market research

so that we remain appropriate and relevant to our members’

needs and expectations. Our delivery channels must ensure

that doing business with the Credit Union is fast, accurate and

efficient.

Through an analysis of behavioural data, management saw

that more and more of our members were engaging the

Credit Union through mobile devices and responded with the

launch of our mobile banking application at the beginning of

the second half of the year. This was further supported by a

revamp of our corporate website which is now mobile friendly.

Successive reports from our annual member survey have noted

a call for an expanded branch network. We are pleased to

report that the branch at Emerald City which registered strong

performances from inception, will shortly be relocated to more

commodious surroundings at the Emerald City Complex, Six