BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

CONSOLIDATED ANNUAL REPORT 2015

12

5.0 percent to 4.7 percent as various pricing strategies were

employed to drive loan and deposit volumes.

These results were the product of outstanding and dedicated

staff. The Group expects a great deal from all of its employees.

They must have deep and broad knowledge of its products,

services, and systems. They must be accurate, efficient, and

compliant. Above all, they must deliver outstanding service

with every single interaction.

Outlook

Undoubtedly, the Group continues to operate in a challenging

economic environment that is already impacting on the

sustainability and future growth of key players in the financial

services sector especially the smaller Credit Unions. Faced with

continuing deterioration in credit quality, there is a constant

need to reassess capital levels, identify stress points and

manage risk exposures.

The Group will continue to respond to the current and future

challenges as it seeks to maintain its positive growth trends.

The impact of large-scale retrenchment of employees in the

public service and the introduction of a 0.2 percent tax on

assets of non-bank financial institutions have taken effect

during the financial year and will continue to do so in the 2016

financial year.

Notwithstanding these circumstances, the Group is well

equipped to whether the challenges which lie ahead.

Economic Review

The local economy continues to struggle as it seeks to recover

from extended periods of negative growth, despite some

growth globally.

According to the most recent economic report, the Barbados

economy is estimated to have grown by less than 1 percent

in 2014. Foreign exchange reserves at the end of December

2014 represented 14.5 weeks of import of goods and services.

Tourism value-added is estimated to have increased by 1

percent thereby reversing a downward trend over the last 3

years.

MANAGEMENT DISCUSSION AND ANALYSIS

This section of the Group’s Annual Report provides a discussion

and analysis of the financial condition and performance of

the consolidated operations of the Barbados Public Workers’

Co-operative Credit Union Limited, and its subsidiaries (“the

Group”) for the financial year ended March 31, 2015.

The Group includes the parent, Barbados Public Worker’s Co-

operative Credit Union Limited, its subsidiary BPW Financial

Holdings Inc. and its subsidiary Capita Financial Services Inc.

(“Capita”).

Overview

At March 31, 2015 the total consolidated assets of the Group

reached $1.1 billion reflecting an average growth of $6.1

million a month during the year ending March 31, 2015.

This growth epitomized the confidence, loyalty and support in

which members and customers have placed in the respective

boards, management and staff of the companies within the

Group.

Snapshot of CAPITA’s Performance

CAPITA has continued to grow from strength to strength since

its acquisition in August 2010, recording an average asset

growth of $1.8 million per year to reach $200 million at March

31, 2015. Its net income after tax has stabilized to average

$1.0 million per year. However, CAPITA continues to expand

offering a wide diversity of other income opportunities for the

Group.

One such opportunity is through the establishment of CAPITA

Insurance Brokers (CIB) which provides brokerage services to

the Group under the CAPITA brand.

Through CIB, the Credit Union’s membership has been provided

with one of the best health benefit plans within the market.

Group Performance Summary

The Group’s consolidated net income for the year under review

totalled $9.6 million compared to $11.1 million for the previous

year. Total tax levied on the assets of the Group for the year

ending March 31, 2015 amounted to $1.6 million.

The Group continued to maintain tight control over the rate of

non-performing loans. Although there was an increase in non-

performing loans by $6.1 million across the Group, the rate of

delinquency increased marginally to 6.8 percent.

A review of the loan portfolio required that the loan impairment

provision be increased by $0.6 million in 2015. However, the

ratio of provision to impaired loans moved from 40 percent in

2014 to 37.1 percent in 2015.

Overall the Group recorded significant growth in its core

businesses. Loan growth moved from 6.5 percent in 2014 to

9.8 percent in 2015.

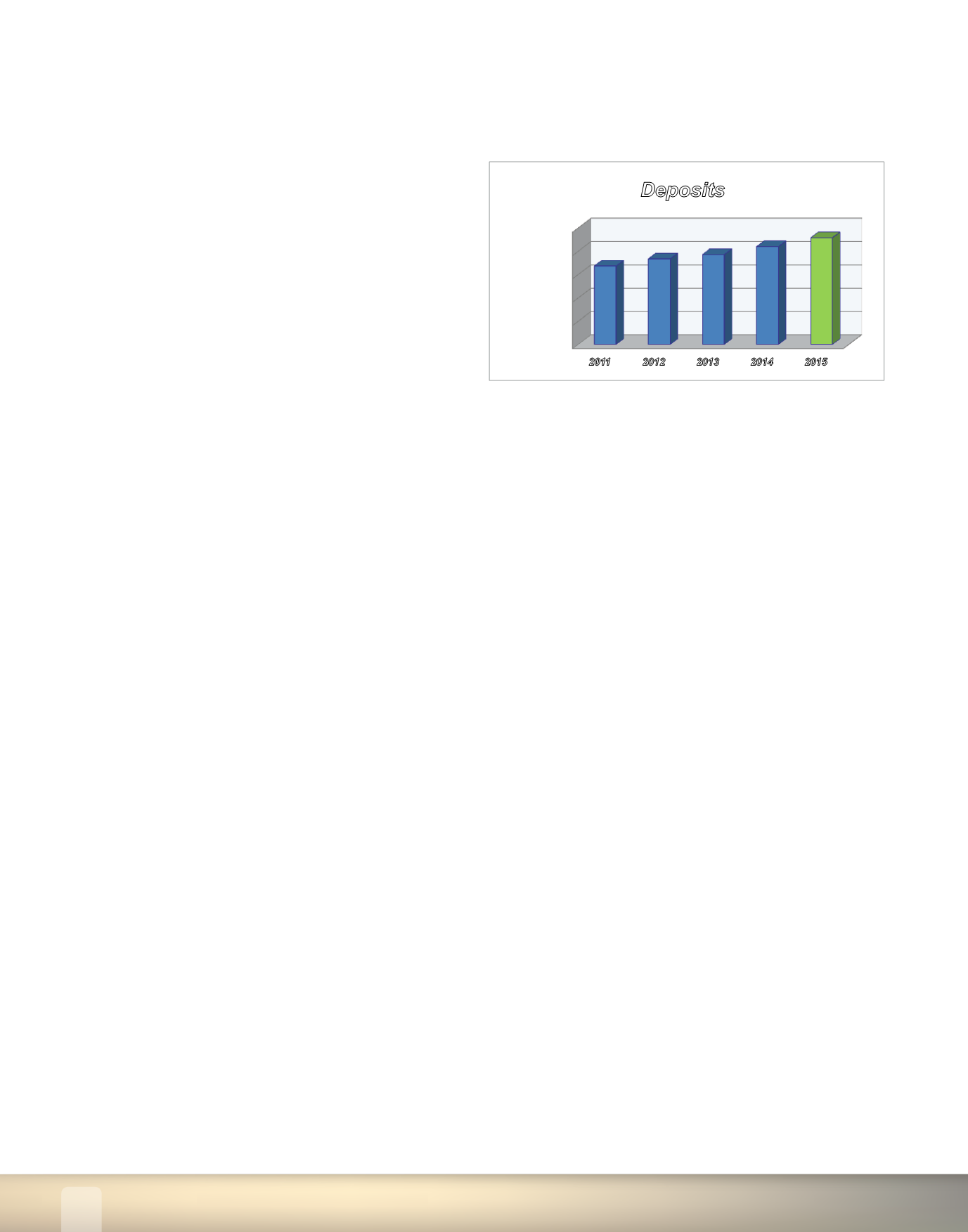

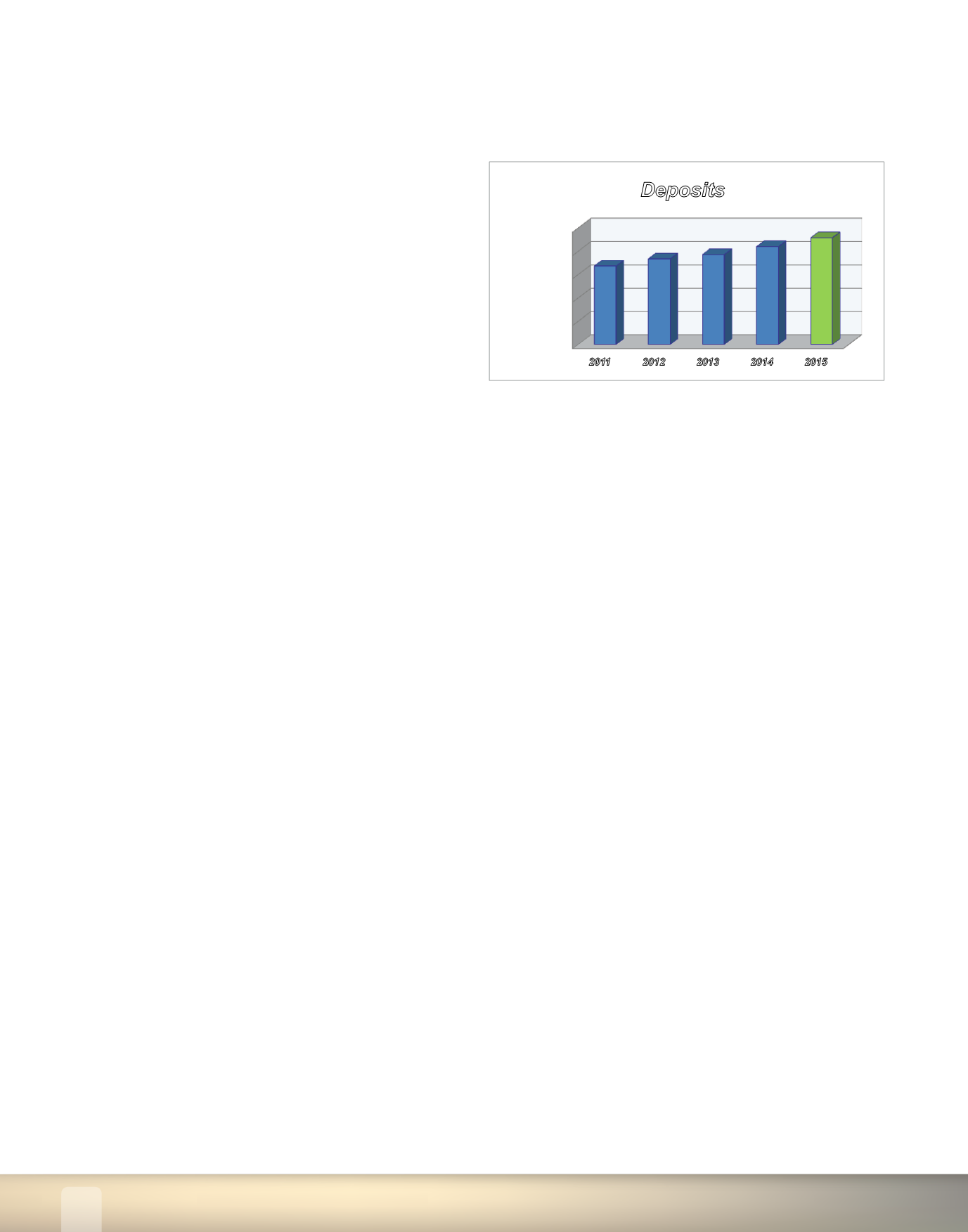

Deposit growth climbed from 8.6 percent in 2014 to 9.1

percent in 2015. Net interest margin declined slightly from

0

200000

400000

600000

2011

2012

2013

2014

2015

In BD$'000

0

200000

400000

600000

800000

1000000

2011

2012

2013

2014

2015

673,773

735,909 772,320

839,052

915,312

In BD$'000

Deposits