BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

NON-CONSOLIDATED ANNUAL REPORT 2016

11

MANAGEMENT DISCUSSION AND ANALYSIS

percent with respect to interest from loans, while interest from

cash deposits and investments decreased by $165.3 thousand

or 4.5 percent during the financial year.

OTHER INCOME

Other income increased by $982.4 thousand or 38.3 percent

during the financial year mainly due to an increase of $639.1

thousand or 161.4 percent in the collection of charged-off

loans.

EFFICIENCY AND EXPENSE MANAGEMENT

The Credit Union’s strategy during the financial year was one

which focused heavily on efficiency and expense management,

while at the same time adding valued member services.

Operating expenses decreased by $327.4 thousand or 1.9

percent compared to prior year.

OPERATING LEASES

Rent expenses increased from $753.1 thousand in 2015 to

$870.7 thousand in 2016. This increase was directly attributed

to the expansion of the Credit Union’s branch operations at the

Six Roads location, installation of two additional offsite ATMs

and rental of office space for staff located at the Co-operators

General Insurance’s building at Collymore Rock.

STAFF COST

During the year, the Credit Union increased its staff

complement to strengthen its member services, compliance

and risk management functions as well as providing adequate

frontline and support personnel.

Additionally, completed union negotiated salary increases

contributed to the increased staff costs by $2.2 million or 17.5

percent over the prior year.

TOTAL OPERATING EXPENSES

Total operating expenses for the year amounted to $36.7

million, which represented an increase of $3.0 million or 8.8

percent above the prior year. Asset Tax expense levied by the

government on the assets of the Credit Union totaled $1.9

million or 0.2 percent. This Tax is scheduled to end effective

March 31, 2016.

NET OPERATING INCOME

Operating income net of loan impairment expenses increased

by $6.9 million or 16.0 percent to end the year at $50.2 million.

Loan impairment expense was $3.8 million, a marginal increase

of $77.2 thousand or 2.1 percent over last year.

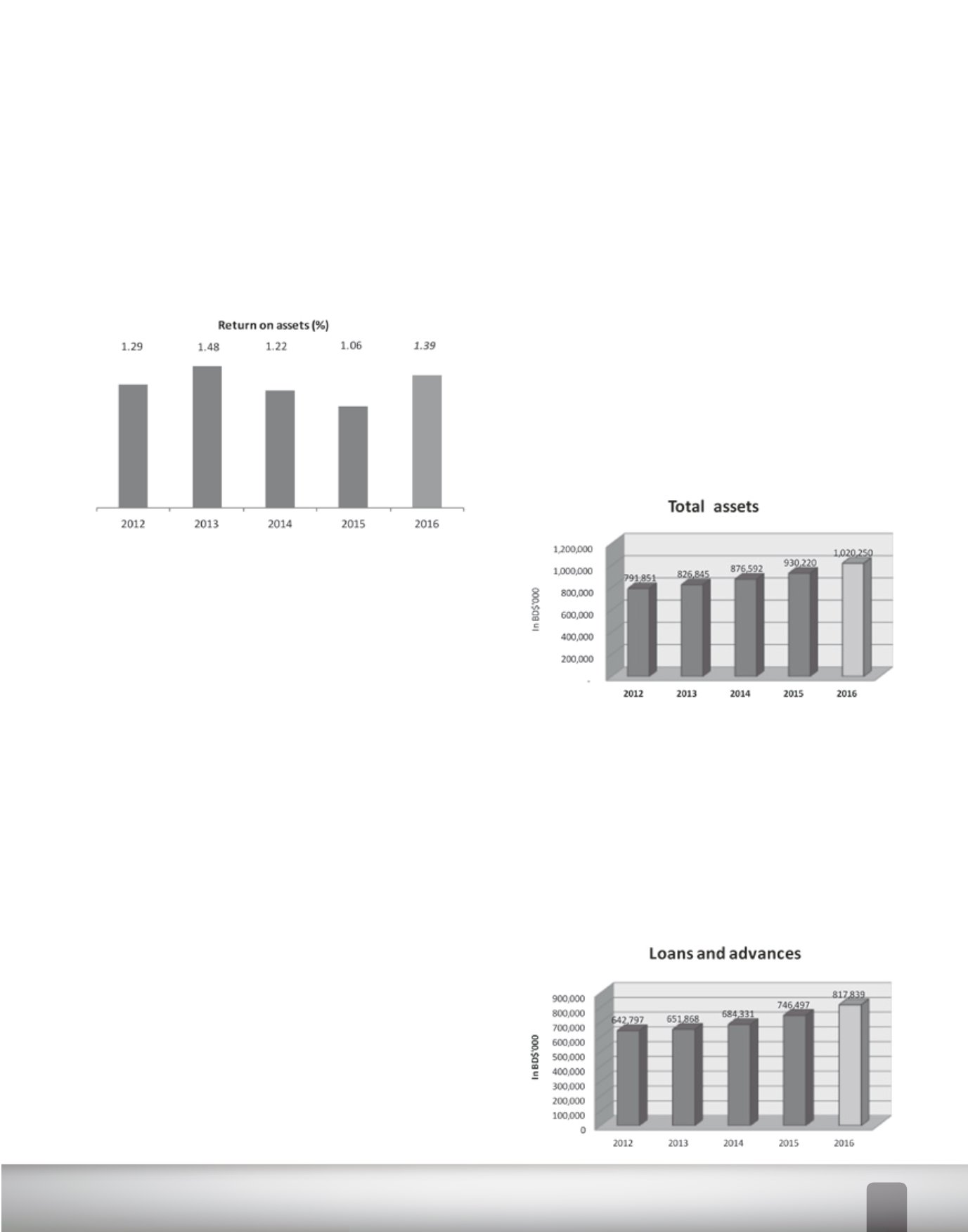

ASSETS

At the end of the financial year, the Credit Union’s total assets

amounted to just over $1.0 billion, an increase of $90.0 million

or 9.7 percent.

Cash resources increased by $8.4 million or 8.9 percent. In

addition, financial investments classified as Held-to-maturity

increased by $3.2 million or 12.5 percent.

Net loans and advances to members were $817.8 million,

inclusive of an impairment provision of $20.5 million, as

compared to $746.5 million and $21.9 million respectively at

the end of the previous year.

ASSET QUALITY

Amid a climate of economic uncertainty and high

unemployment, the Credit Union recorded a decrease of 0.4

percent in its delinquency ratio which ended the year at 6.3

percent compared to the prior year at 6.7 percent.