BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

NON-CONSOLIDATED ANNUAL REPORT 2016

10

mostly to concentration and credit quality. However, we

reduced our delinquency ratio to 6.3 percent, down by 0.4

percent from previous year. This was achieved by prudent and

continuous management of our loan portfolio.

We continued to offer payment solutions to our members

through various debt management and consolidation strategies

to improve their financial and economic well-being.

Non-performing loans during the year ending March 31,

2016 increased by $1.8 million or 3.5 percent. However, the

delinquency rate decreased from 6.7 percent at March 31,

2015 to 6.3 percent at March 31, 2016. We will continue

to work with our membership to offer solutions geared at

returning their accounts to a state of normalcy.

Deposit interest rates in the market continued to trend

downward and reached an average of 0.5 percent at March

31, 2016. However, we at the Credit Union are proud to

maintain some of the most competitive rates on deposits. This

resulted in deposit growth for the year of $87.8 million.

REVIEW OF FINANCIAL PERFORMANCE

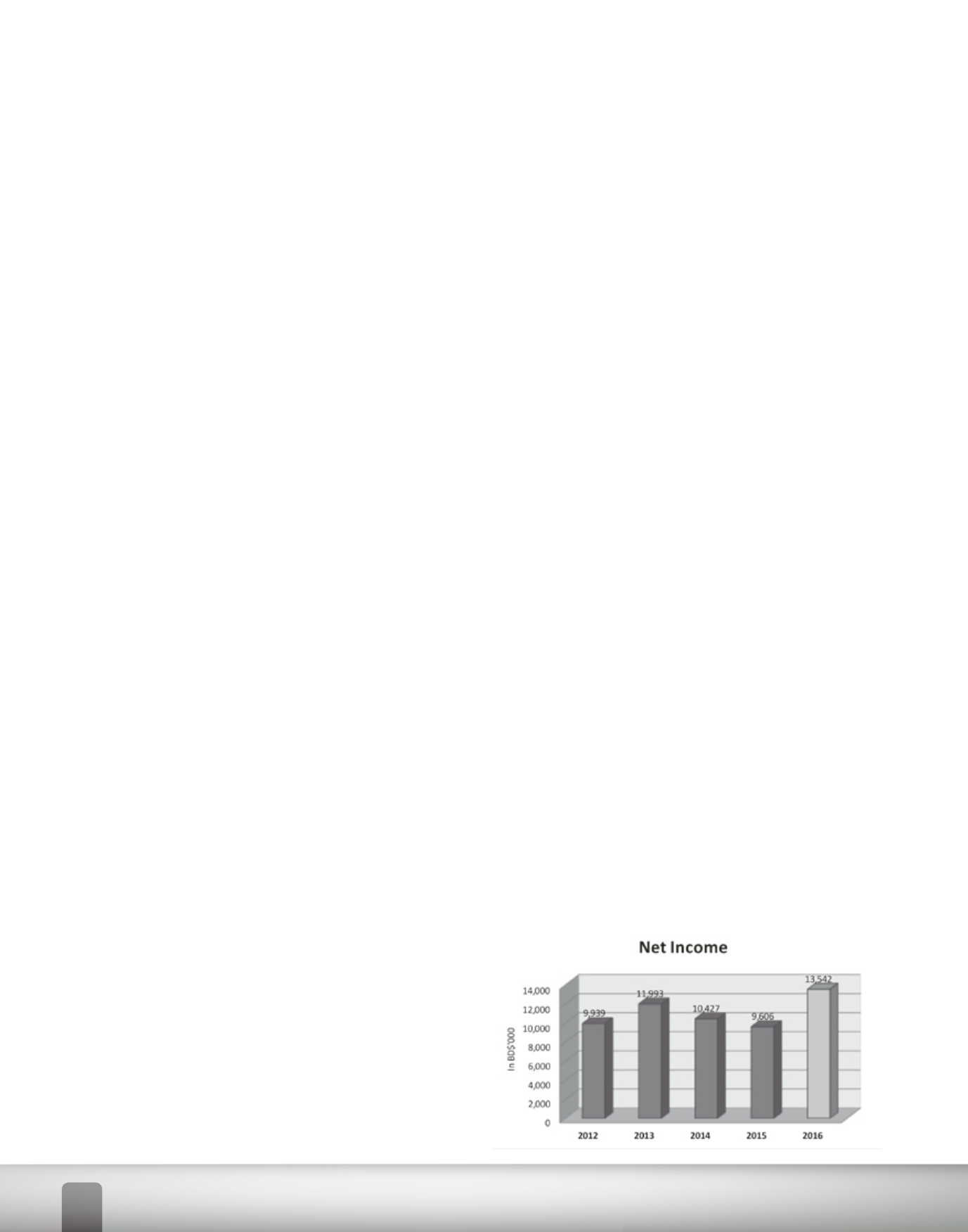

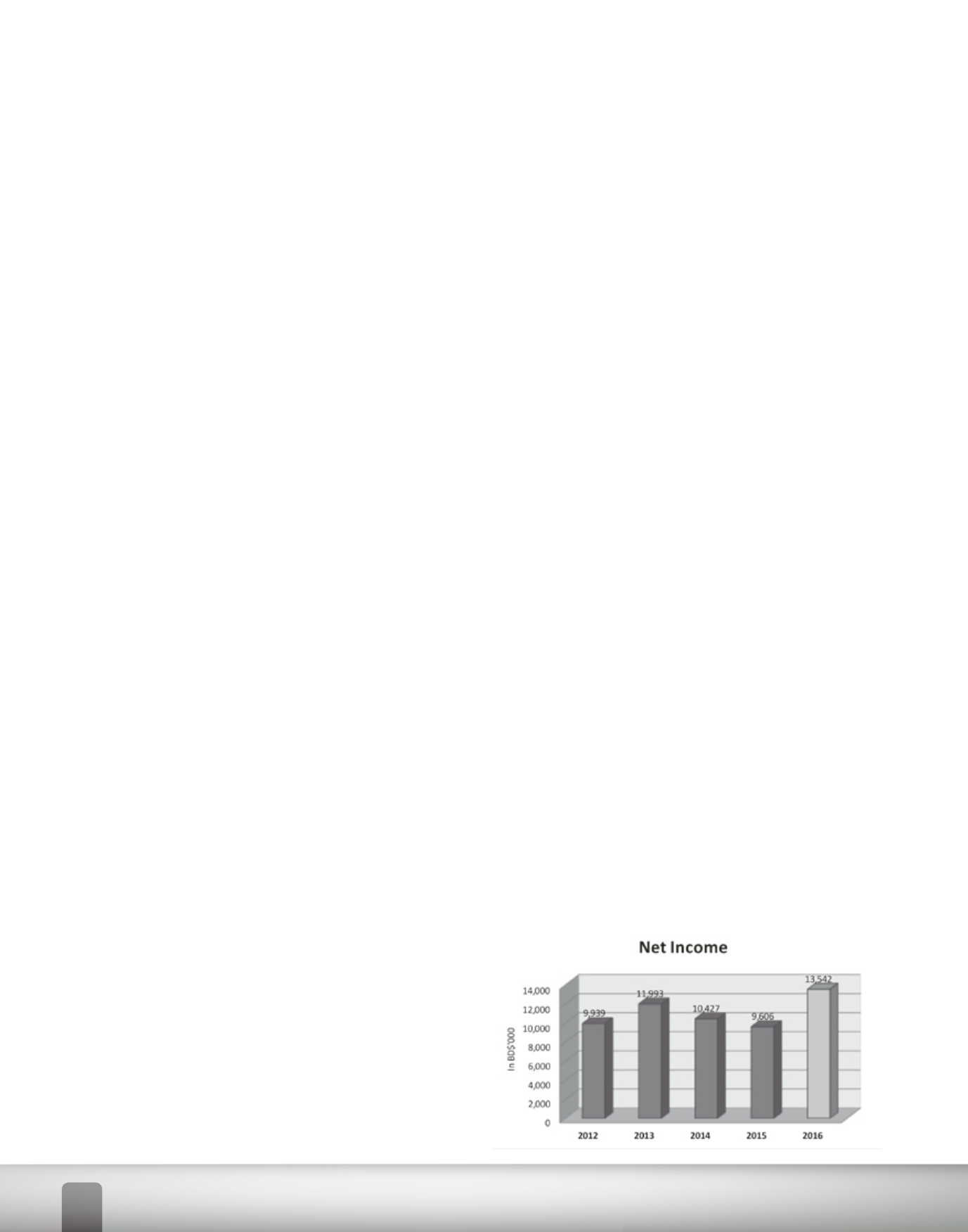

TOTAL INCOME AND NET INCOME

With asset taxes of $1.9 million incurred during the year, net

income was reported at $13.5 million compared to $9.6 million

in the prior year, an increase of $3.9 million or 41 percent.

Total revenue grew by $8.2 million or 11.4 percent, moving

from $71.7 million in 2015 to $79.9 million during the 2016

financial year.

The Credit Union achieved significant net loan growth when

compared to prior years, as net loans grew by $71.3 million

or 9.6 percent when compared to $62.2 million for the year

ended March 31, 2015.

NET INTEREST INCOME

Net interest income grew by $6 million or 13.5 percent in 2016.

Total interest income grew by $7.2 million or 10.4 percent,

while total interest expense increased by $1.2 million or 4.9

percent. Interest income increased by $7.4 million or 11.3

MANAGEMENT DISCUSSION AND ANALYSIS

This section of the Annual Report provides a discussion and

analysis of the financial condition and performance of the

Barbados Public Workers’ Co-operative Credit Union Limited

(BPWCCUL) for the financial year ended March 31, 2016 as

compared to the prior financial year ended March 31, 2015.

ECONOMIC REVIEW

At the end of 2015, the Barbadian economy was estimated

to grow by 0.5 percent, mainly due to the stellar performance

of the tourism industry. The financial system in Barbados has

demonstrated its resilience and maintained excess liquidity in

2015 despite the challenging local and international economic

environment. It is forecasted that in the 2016/2017 financial

year, the economy is expected to grow by 1.6 percent.

Despite the economic climate as highlighted in the Financial

Stability Report from the Central Bank of Barbados, total

assets of the Credit Union Sector were reported at $1.9 billion

dollars in 2015, representing a 7.0 percent increase over 2014.

The largest contributor to growth was the aggregate loan

portfolio, increasing by 7.0 percent, followed by an increase in

investments of 6.0 percent. From January to September 2015,

total new loans of $208.0 million were concentrated mostly

in consumer loans ($106 million), real estate ($62 million) and

transport ($36 million). Average liquidity in the Credit Union

Sector remained stable.

Non-performing loans relative to the total loan portfolio fell

from 9.1 percent to 8.9 percent at September 2015. However,

the quality of the loan portfolio was relatively skewed where

smaller credit unions were recorded to have had substantially

higher non-performing loan ratios than that of the larger ones.

According to the most recent report published by the

CUNA Mutual Group on Credit Unions in the USA, during

February 2016, Credit Unions picked-up 820.0 thousand in

new membership, loan and savings balances grew at 11.0

percent and 8.1 percent seasonally-adjusted annualized pace,

respectively.

Additionally it was reported that total Credit Union assets rose

by 1.6 percent in February, below the 1.9 percent gain reported

in February of 2015. Assets rose 6.1 percent during the past

year due to a 5.7 percent increase in deposits, a 12.4 percent

increase in borrowings and a 7.6 percent increase in capital.

OVERVIEW

During the year under review, the Credit Union continued to

grow in key aspects of its operations. Membership averaged

447 per month and recorded net growth of 5,363. Deposits

grew by $87.8 million or 11.3 percent, while assets grew by

$90.0 million or 9.7 percent.

The key area of risk faced by the Credit Union sector relates