BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

NON-CONSOLIDATED ANNUAL REPORT 2016

73

BARBADOS PUBLIC WORKERS' CO-OPERATIVE CREDIT UNION LIMITED

Notes to the Non-consolidated Financial Statements

For the year ended March 31, 2016

(Expressed in Barbados dollars)

57

25. Fair Value,

continued

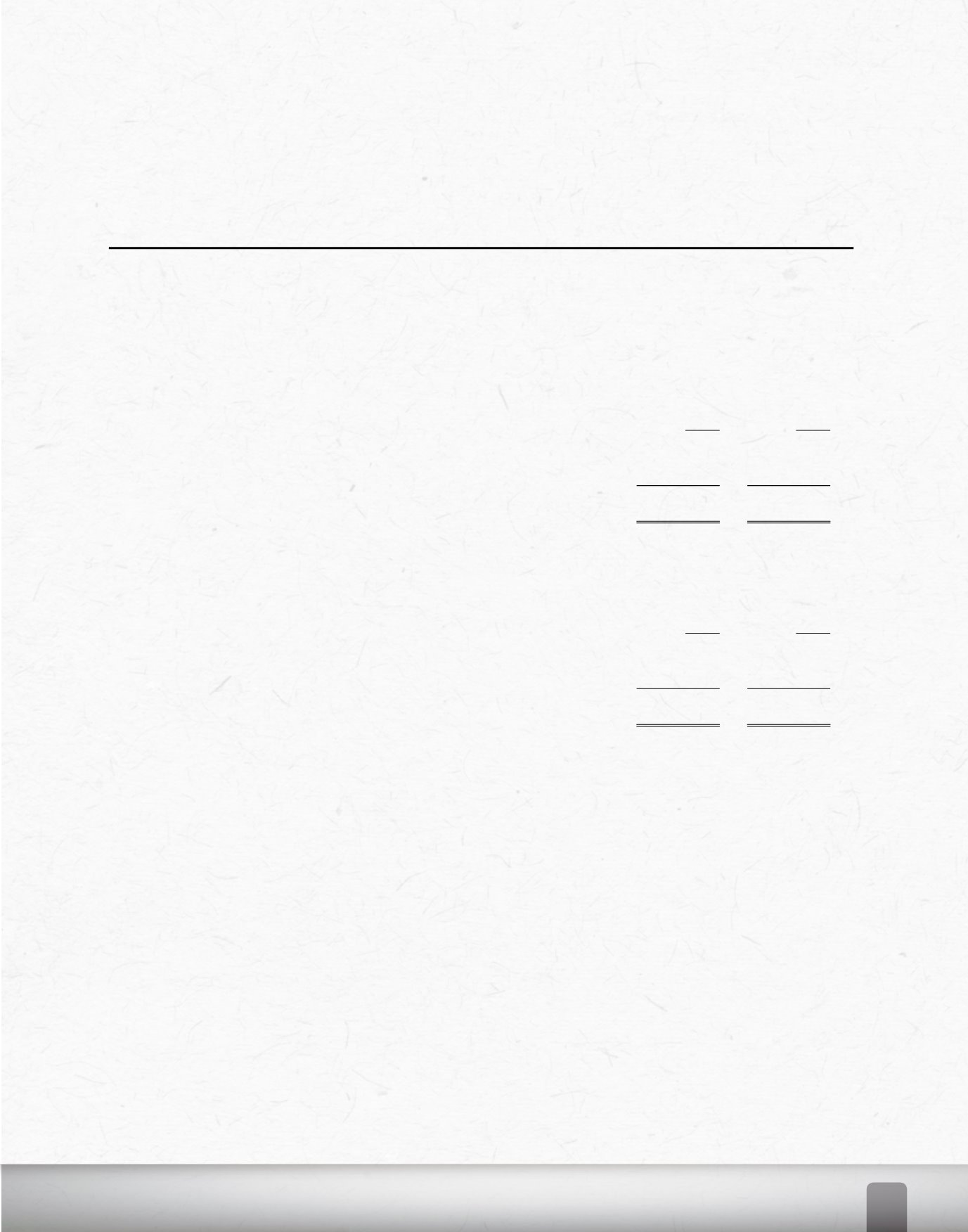

The following table shows a reconciliation of all movements in the fair value of financial investments

categorised within Level 1 between the beginning and end of the reporting period.

2016

2015

Balance - beginning of year

$

1,205,000

1,290,000

Unrealised gain (loss)

320,000

(85,000)

Balance - end of year

$ 1,525,000

1,205,000

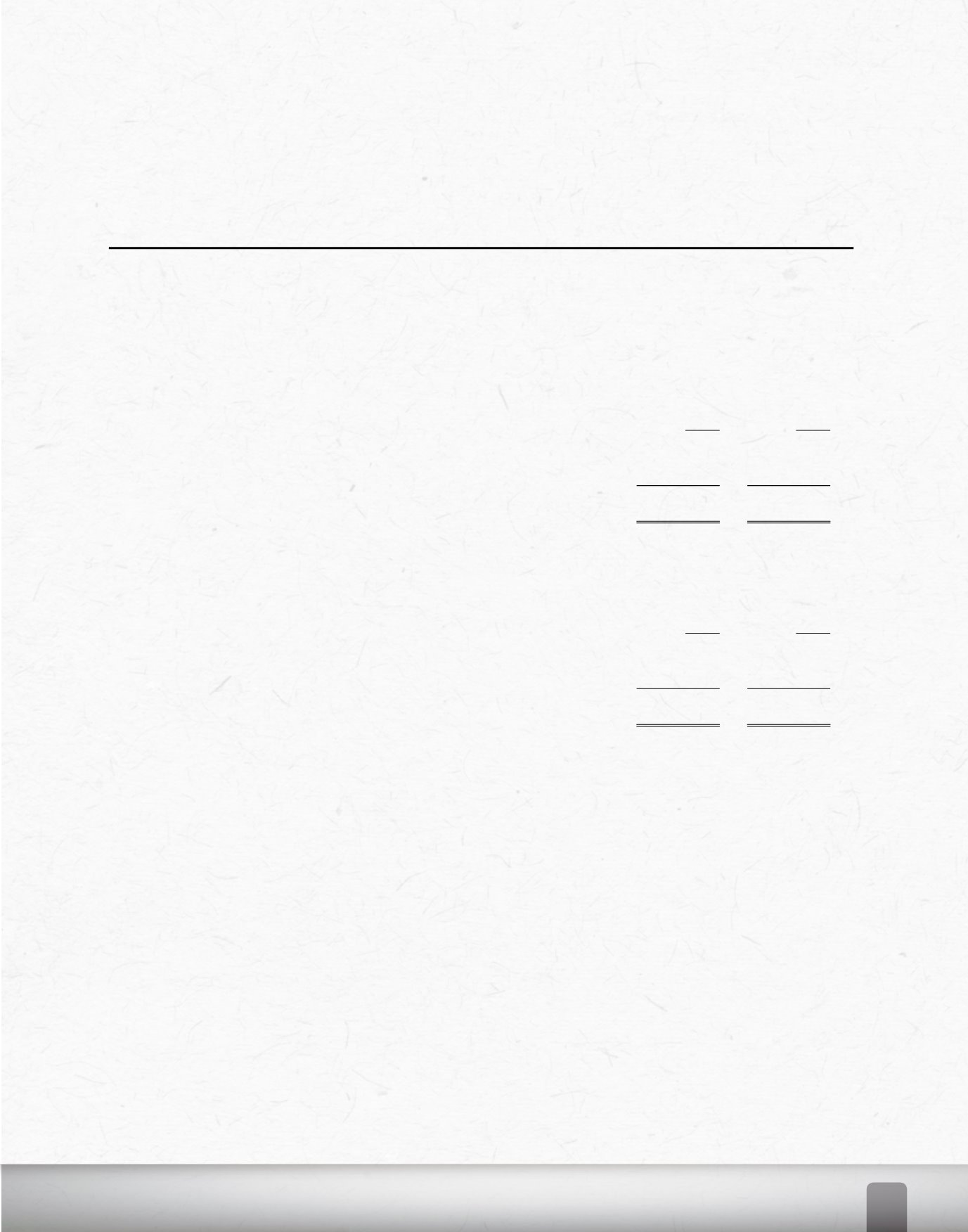

The following table shows a reconciliation of all movements in the fair value of financial investments

categorised within Level 3 between the beginning and end of the reporting period.

2016

2015

Balance - beginning of year

$

682,522

664,348

Purchases

71,916

18,174

Balance - end of year

$

754,438

682,522

There were no transfers in or out of Level 3 during the year ended March 31, 2016 (2015 - nil).

The financial investments classified as Level 3 securities are carried at cost as fair value cannot be

reliably estimated. Therefore no significant unobservable inputs have been considered in determining

its value. The application of sensitivity analysis is therefore not relevant.

26. Capital Management

The Credit Union’s objectives when managing capital, which is a broader concept than the ‘equity’ on

the face of the statement of financial position, are:

•

To comply with the capital requirements set by the regulators of financial institutions where the

Credit Union operates;

•

To safeguard the Credit Union’s ability to continue as a going concern so that it can continue to

provide returns to its shareholders and benefits to other stakeholders; and

•

To maintain a strong capital base to support the development of its business.