BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

NON-CONSOLIDATED ANNUAL REPORT 2016

71

BARBADOS PUBLIC WORKERS' CO-OPERATIVE CREDIT UNION LIMITED

Notes to the Non-consolidated Financial Statements

For the year ended March 31, 2016

(Expressed in Barbados dollars)

55

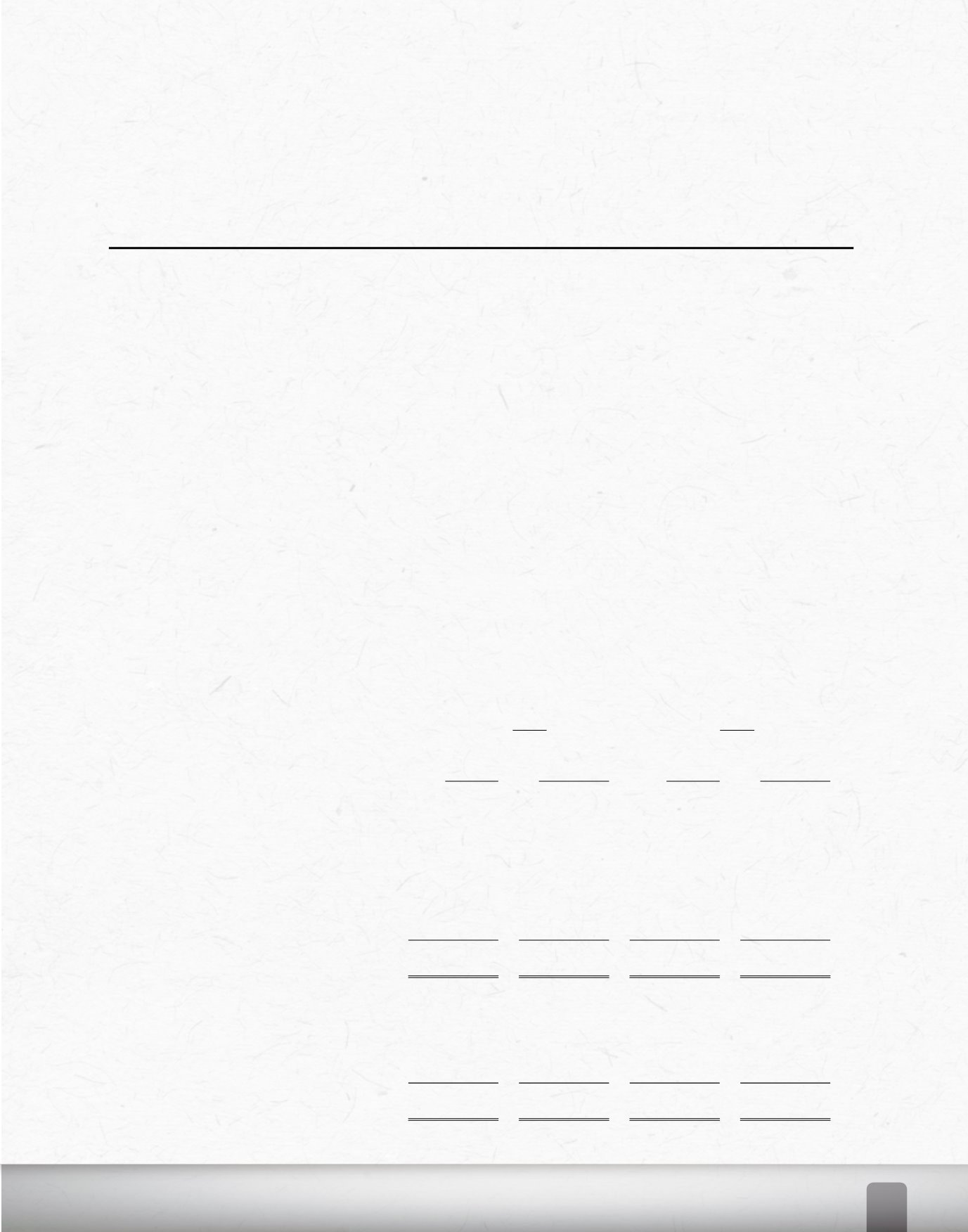

25. Fair Value

Fair value represents the price that would be received to sell an asset or paid to transfer a liability in an

orderly transaction between market participants at the measurement date and is best evidenced by a

quoted market price, if one exists.

Financial assets and liabilities are carried at amounts, which approximate to their fair value at the

statement of financial position date. Fair value estimates are made at a specific point in time, based on

market conditions and information about the financial instrument.

These estimates are subjective in nature and involve uncertainties and matters of significant judgment

and therefore, cannot be determined with precision. Changes in assumptions could significantly affect

the estimates.

For financial assets and financial liabilities that are liquid or have short term maturity, it is assumed that

the carrying amounts approximate their fair value. These include cash resources, other assets and other

liabilities. The fair value of debt securities is based on quoted prices where available, or otherwise based

on an appropriate yield curve with the same remaining term to maturity. The fair value of loans and

advances largely approximates carrying value as the Credit Union's portfolio comprises mainly variable

rate loans. The fair value of deposits takes account of certain fixed rate deposits which have been

discounted at current interest rates.

The fair values of financial assets and liabilities, together with the carrying amounts shown in the

statement of financial position are shown in the table below:

2016

2015

Carrying

Carrying

Amount

Fair Value

Amount

Fair Value

Assets

Cash resources

$ 102,162,229 102,162,229

93,772,722

93,772,722

Financial investments

– Held-to-maturity

29,074,183

29,074,183

25,838,462

25,838,462

– Available-for-sale

2,279,438

2,279,438

1,887,522

1,887,522

Loans and advances

817,838,770 821,034,899 746,496,939 748,817,106

Due from related companies

17,307,614

17,307,614

17,425,274

17,425,274

Other assets

5,112,570 5,112,570 3,937,049 3,937,049

$ 973,774,804 976,970,933 889,357,968 891,678,135

Liabilities

Deposits

$ 862,899,691 932,725,605 775,116,285 854,933,669

Loans payable

22,283,315

22,283,315

33,445,132

33,445,132

Reimbursable shares

7,165,090

7,165,090

6,700,221

6,700,221

Other liabilities

8,558,025 8,558,025 7,418,620 7,418,620

$ 900,906,121 970,732,035 822,680,258 902,497,642