11

BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

CONSOLIDATED ANNUAL REPORT 2016

The 0.2 percent tax on assets of Credit Unions is expected to

cease at March 31, 2016. The impact of the asset tax for its

duration was an overall cost of $3.9 million to the Group, of

which $2.3 million was expensed in income year 2016.

Economic Review

According to the most recent economic reports, the Barbadian

economy is estimated to have grown by 0.5 percent in 2015.

Foreign exchange reserves at the end of December 2015

represented 12 weeks of import of goods and services.

Tourist arrivals were up 14.9 percent for the first nine months

of 2015 while unemployment averaged 11.3 percent, down

from 12.3 percent in the previous year. Additionally, net public

sector debt to GDP was estimated at 70.0 percent at the end

of March 2016 compared to 73.0 percent a year earlier.

Economic Outlook

Despite modest growth in 2015, it is forecasted that the

economy is expected to grow by 1.5 percent in 2016 and 1.7

percent in 2017.

This growth is expected to come from tourism and construction

activities. Further, the Central Bank anticipates that the

implementation of new revenue measures in 2015/2016, along

with the current revenue measures are expected to reduce the

GDP’s deficit to 5.4 percent.

Consolidated Financial Statement Highlights

Revenues

For the financial year ended March 31, 2016, the Group

earned total interest revenue of $89.5 million, up from $80.9

million for the previous year. This represented an increase of

$8.6 million or 10.6 percent for the year and is attributable

to the steady growth in both consumer and mortgage loans

across the Group.

Income generated from non-interest sources increased by $1.3

million or 34.6 percent when compared with the previous

year, primarily as a result of increased efforts in impaired loan

recoveries.

Net Interest Income

The marginal lowering of the savings and deposits interest

rates during the year, along with prudent management of the

interest spread, resulted in consistent growth in net interest

income during the year.

Net interest income moved from $49.8 million in 2015 to

$56.5 million at March 31, 2016. This represented a $6.7

million or 13.5 percent increase. This was positively impacted

by increased loan volumes and a reduction in funding costs.

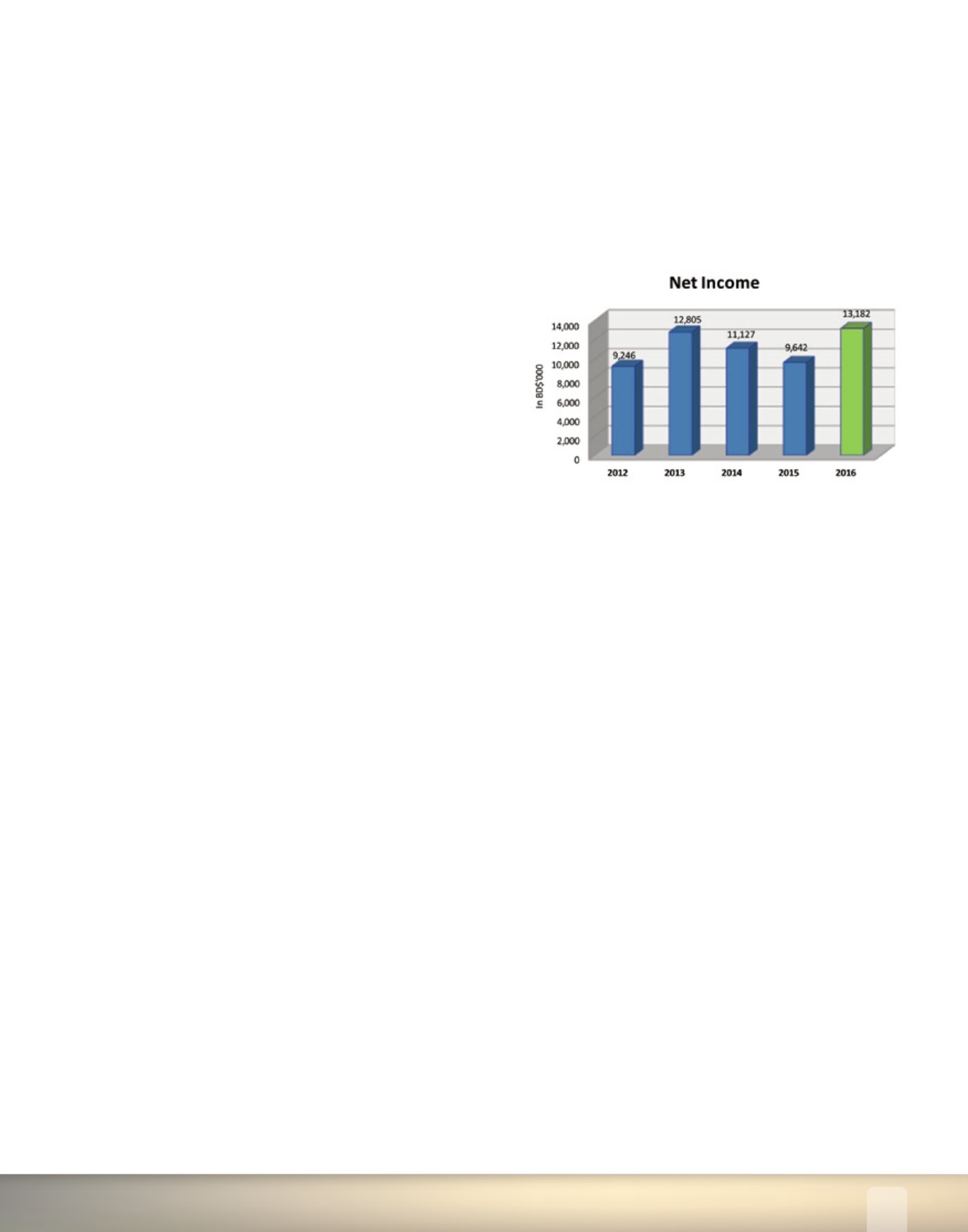

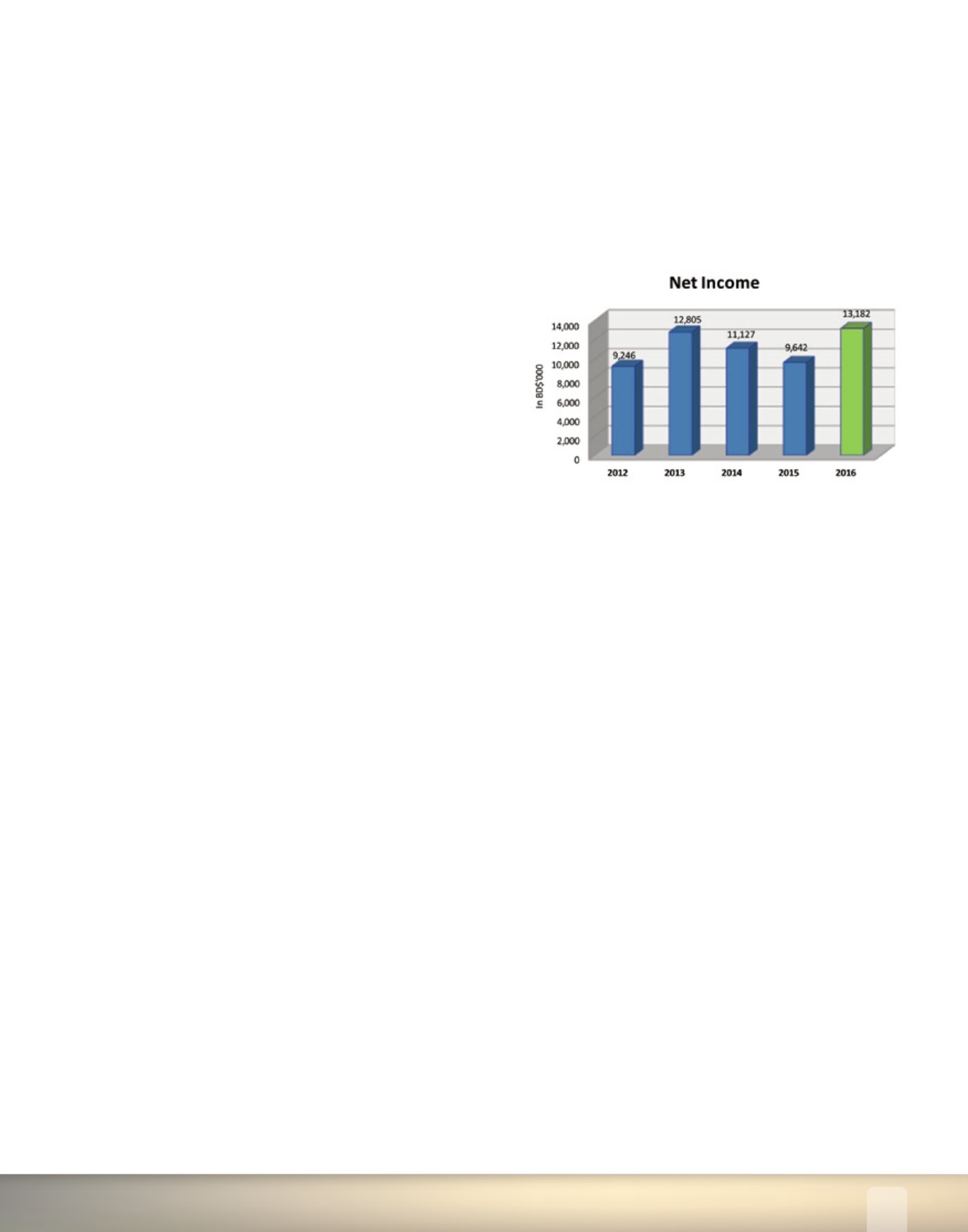

Net Income

The Group earned consolidated net income before tax of

$15.8 million for the year ended March 31, 2016 compared

with $11.4 million for the previous year. This represented an

increase of approximately $4.4 million or 38.6 percent above

the prior year.

Operating Expenses

Total operating expenses inclusive of taxes increased from $39.9

million at March 31, 2015 to $44.1 million for 2016 and was

driven principally by the tax on assets, increases in staff costs,

publicity and promotion and membership security.

The increase in staff costs amounted to $2.6 million and is

mainly due to two years contractual union negotiated salary

increases which were finalized in 2016 and new staff positions

in both the Credit Union and CAPITA during the year.

The growth in deposits and loans in the Group resulted in the

increase of membership security expense from $2.4 million in

2015 to $2.5 million in 2016.

Assets

Total assets of the Group stood at $1.2 billion at March 31,

2016. This represented an increase of $125.4 million or 11.5

percent over the previous year.

At March 31, 2016, the Group consolidated net loans and

advances stood at $1.0 billion, as compared to $906.1 million at

the end of March 31, 2015. This represented an overall increase

of $95.4 million or 10.5 percent growth in loans compared to

an increase of $80.9 million one year ago.

The Credit Union led the growth in the mortgage loan portfolio

which accounted for approximately $26.3 million of the

growth. Consumer loans also contributed significantly to the

loan growth at the Credit Union, accounting for $42.7 million

of the portfolio increase.

This increase resulted from a more targeted marketing

approach, innovative loan promotions and from continuous

streamlining of the loan approval and disbursement processes.

MANAGEMENT DISCUSSION AND ANALYSIS

(continued)