BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

CONSOLIDATED ANNUAL REPORT 2016

10

The Group’s net loan impairment provision decreased by $992

thousand in 2016. Consequently, the ratio of loan provisioning

to impaired loans moved from 42.6 percent in 2015 to 39.0

percent in 2016.

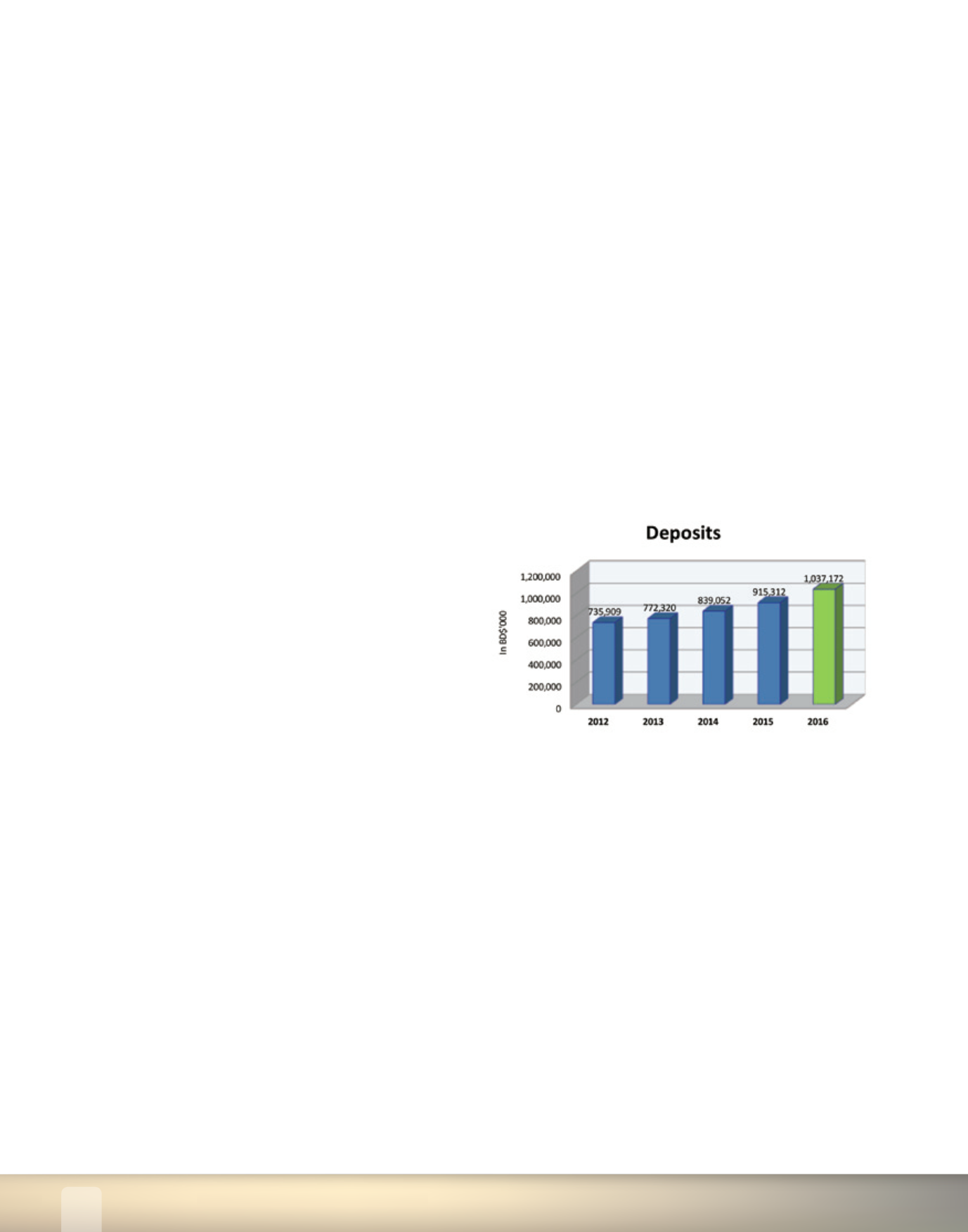

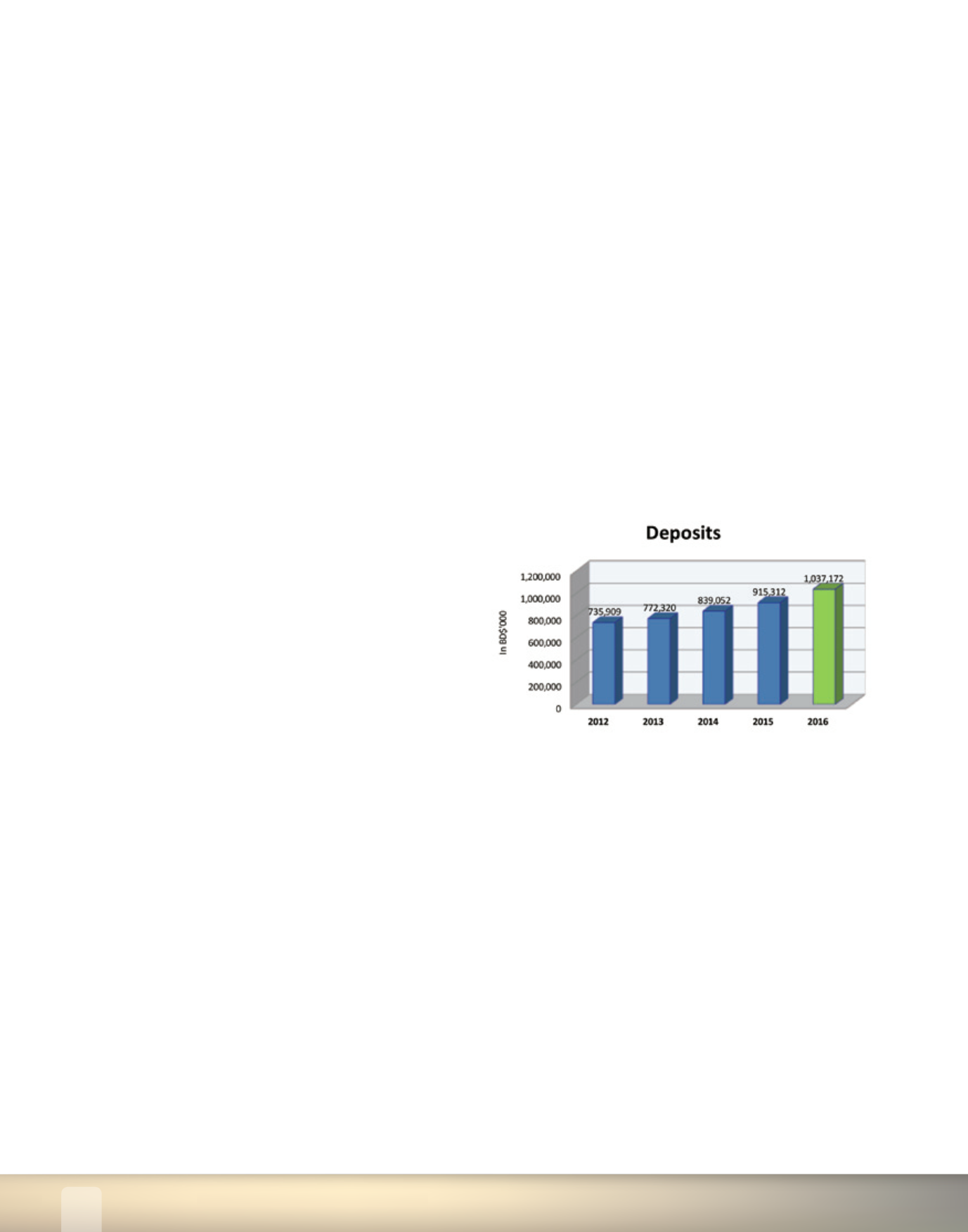

Overall the Group recorded significant growth in its core

businesses. Loan growth moved from 9.8 percent in 2015

to 10.5 percent in 2016. Deposit growth climbed from 9.1

percent in 2015 to 13.3 percent in 2016.

During the financial year, the Central Bank of Barbados relaxed

its control over interest rates in the market. This allowed

financial institutions to lower their interest rates on various

savings and deposit products.

The interest rate on deposits at some leading financial

institutions average 0.5 percent at March 31, 2016. The

minimum interest rate on deposits within the Group at March

31, 2016 stood at 2.0 percent.

Net interest margin increased from 4.7 percent in 2015 to 4.9

percent in 2016 as various pricing strategies were employed to

drive loan and deposit volumes.

These results are credited to the performance of outstanding

and dedicated employees who were encouraged to have

a deep and broad knowledge of our products, services and

systems. They are trained to be professional, accurate, efficient

and compliant. We foster an environment of outstanding

service delivery to our members and customers with every

single interaction.

Outlook

Undeniably, the Group continues to operate in a challenging

economic environment that is already impacting on the

sustainability and future growth of key players in the financial

services sector, especially the smaller Credit Unions. Faced with

continuing deterioration in credit quality, there is a constant

need to reassess capital levels, identify stress points and

manage risk exposures.

The Group will continue to respond to the current and future

challenges through iterative processing of its vision goals as it

seeks to maintain positive growth trends.

MANAGEMENT DISCUSSION AND ANALYSIS

This section of the Group’s Annual Report provides a discussion

and analysis of the financial position and performance of the

consolidated operations of the Barbados Public Workers’

Co-operative Credit Union Limited, and its subsidiaries (“the

Group”) for the financial year ended March 31, 2016.

The Group includes the parent, Barbados Public Workers’ Co-

operative Credit Union Limited, its subsidiary BPW Financial

Holdings Inc. and its subsidiaries CAPITA Financial Services Inc.

(“CAPITA”) and Capita Insurance Brokers Limited (“CIB”).

Overview

At March 31, 2016 the total consolidated assets of the Group

reached $1.2 billion, reflecting an average growth of $10.5

million per month during the year ending March 31, 2016.

This growth signals the confidence, loyalty and support in

which members and customers have placed in the respective

boards, management and staff of the financial institutions

within the Group.

Snapshot of CAPITA’s Performance

CAPITA continued to realize steady growth since its acquisition

in August 2010, recording asset growth of $35.2 million or

17.5 percent for the year to reach $236.7 million at March 31,

2016. Its pre-tax net income was $1.0 million while net income

after tax was $658.8 thousand for the year.

Additionally, CAPITA continued to expand by offering a wide

diversity of other income opportunities for the Group. One such

opportunity is through the establishment of CAPITA Insurance

Brokers Limited (CIB) which provided brokerage services to the

Group under the CAPITA brand.

As a measure of the confidence in its future growth and

profitability, CAPITA commenced the payment of a dividend

to its sole shareholder in 2015 and has declared a dividend of

$400 thousand for 2016.

Through CIB, the Credit Union’s membership has been provided

with one of the best health benefit plans in the market.

Group Performance Summary

The Group’s consolidated net income before tax for the year

under review was $15.8 million compared to $11.4 million for

the previous year. It is worthy to note however, that the tax

levied on the assets of the Group for the year ending March

31, 2016 amounted to $2.3 million together with Corporation

Tax of $268.8 thousand. This resulted in net income after tax

of $13.2 million for the Group.

The Group continued working with members and customers

who have been experiencing challenges in meeting loan

commitments. As a consequence, the percentage rate of non-

performing loans decreased by $2.4 million across the Group.

The delinquency rate decreased from 6.7 percent at the end of

the previous year to 6.3 percent at the end of March 31, 2016.