BARBADOS PUBLIC WORKERS' CO-OPERATIVE CREDIT UNION LIMITED

Notes to the Non-consolidated Financial Statements

For the year ended March 31, 2013

(Expressed in Barbados dollars)

27

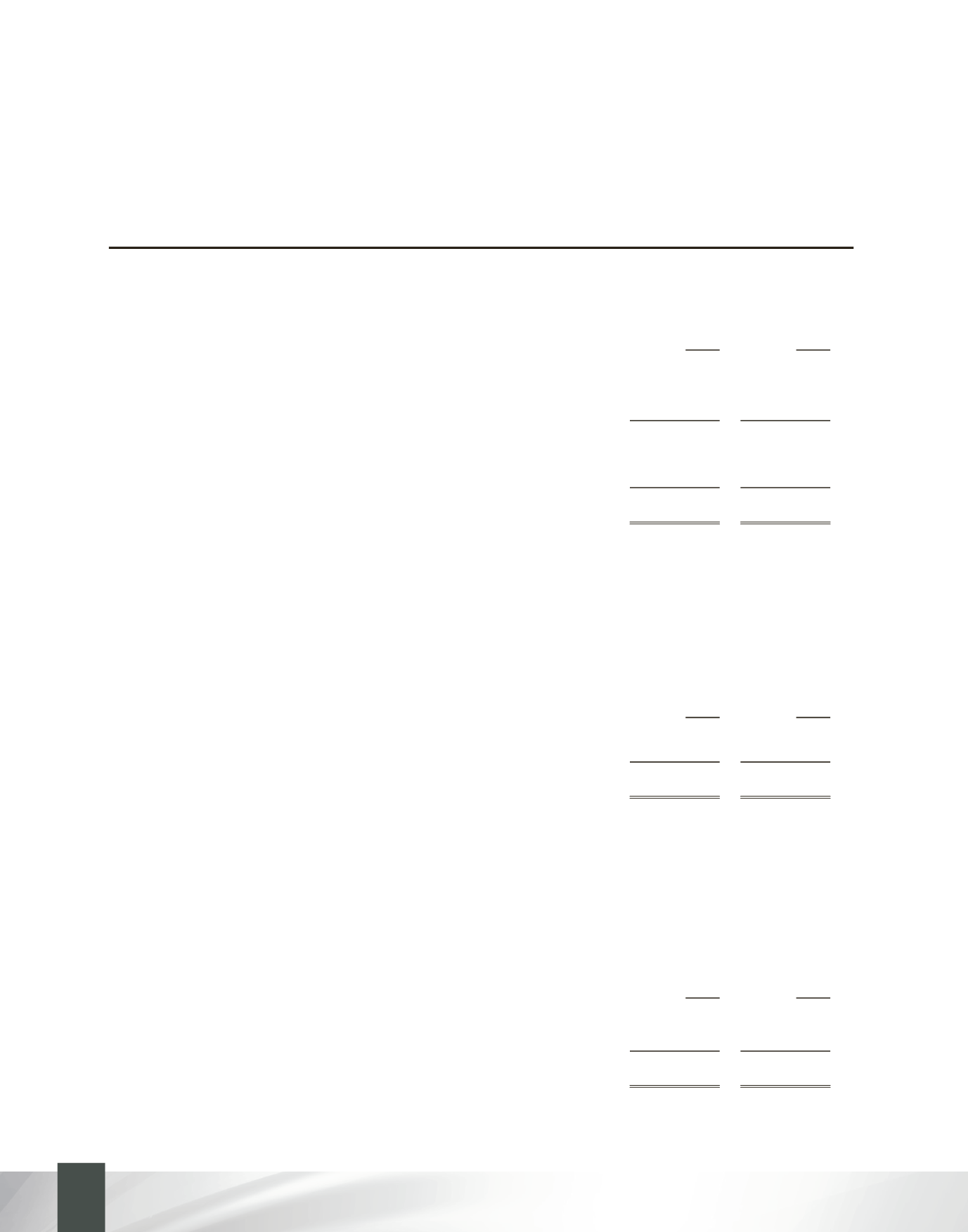

16. Deposits

This amount comprises:

2013

2012

Saving deposits

$ 368,581,768 358,936,693

Deposits payable on fixed date

273,243,832 261,151,315

Registered retirement savings plan deposits (i)

27,944,200 24,257,386

669,769,800 644,345,394

Interest payable

2,633,545 2,089,842

$ 672,403,345 646,435,236

(i)The Credit Union operates a registered retirement savings plan for the benefit of its members and

guarantees a minimum return on plan deposits of the higher of 5.0% or 1.0% above the minimum

deposit rate. At March 31, 2013 the minimum deposit rate was 2.5% (2012 - 2.5%).

Concentration of deposits

Deposits (excluding interest payable) comprised the following:

2013

2012

Personal

$ 643,296,073 609,403,275

Commercial

26,473,727 34,942,119

$ 669,769,800 644,345,394

At March 31, 2013, deposits pledged as security for loans to members and not available for withdrawal

totalled $252,058,172 (2012 - $266,020,146). The average yield of deposits during the year was 3.04%

(2012 - 3.3%).

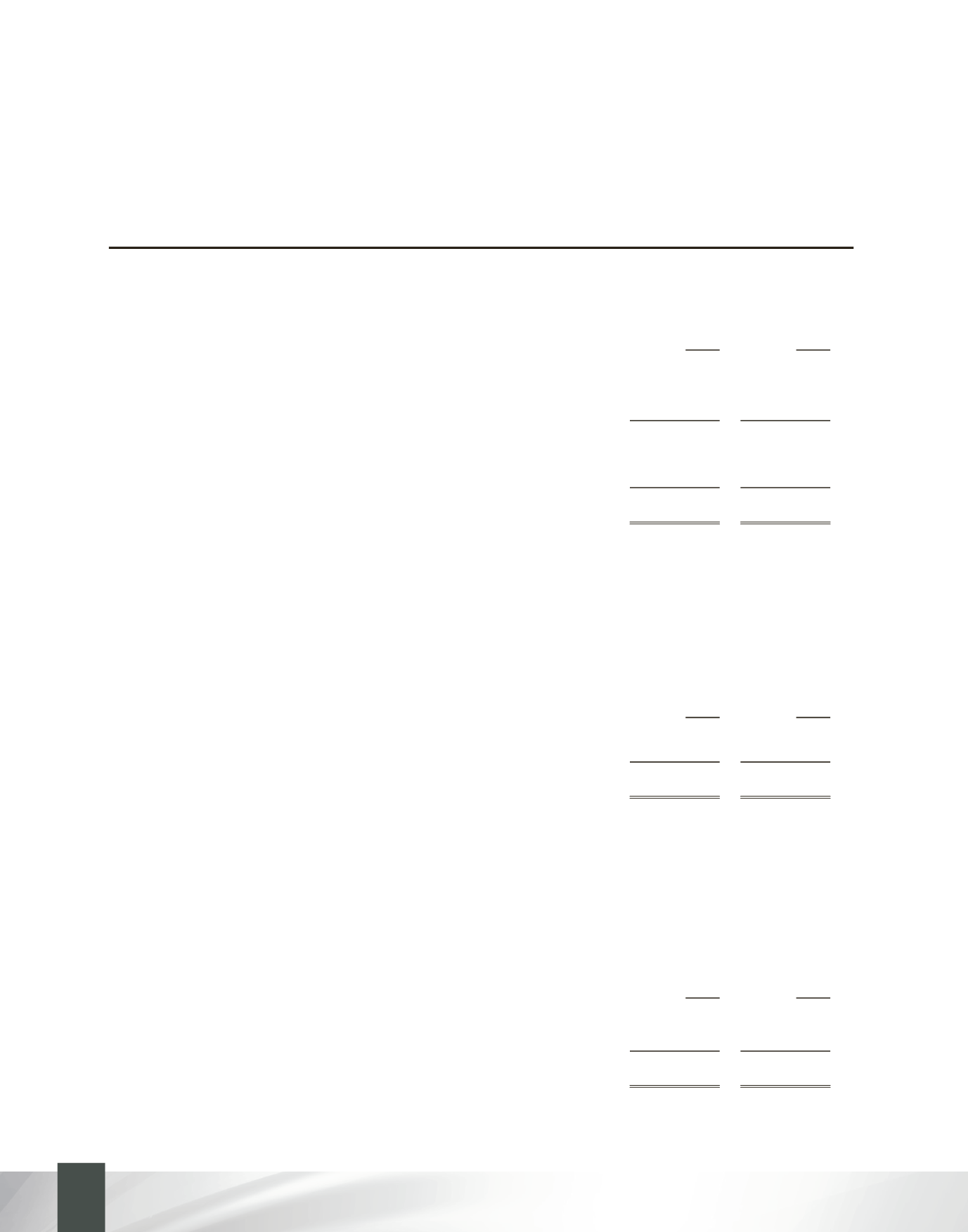

17. Loans Payable

Loans payable is comprised of the following:

2013

2012

National Insurance Board (i)

$ 40,785,133

44,125,614

Housing Credit Fund (ii)

14,647,241 15,535,393

$ 55,432,374 59,661,007

36

BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

ANNUAL REPORT 2013