BARBADOS PUBLIC WORKERS' CO-OPERATIVE CREDIT UNION LIMITED

Notes to the Non-consolidated Financial Statements

For the year ended March 31, 2013

(Expressed in Barbados dollars)

24

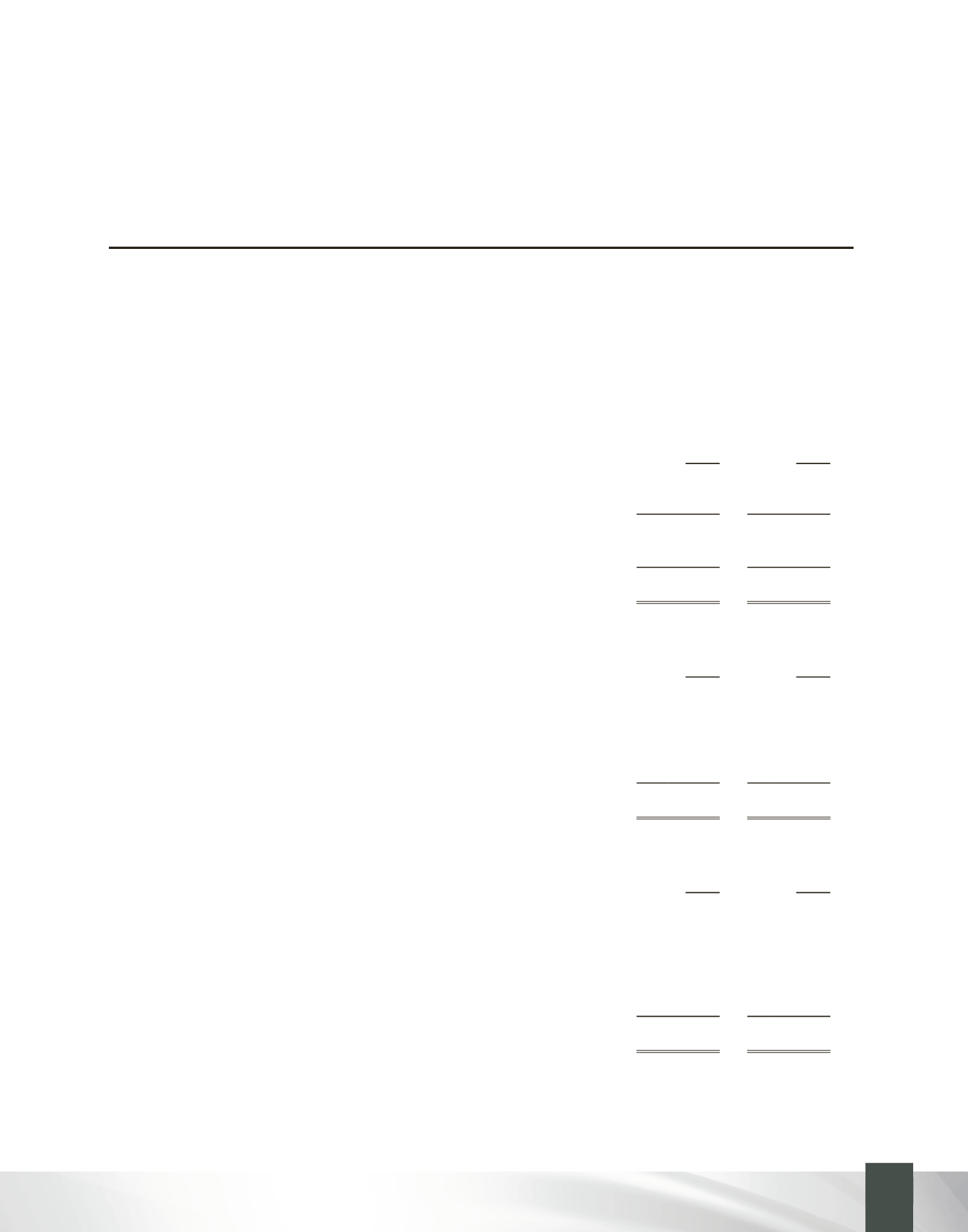

12. Pension Plan Asset

The Credit Union participates in a defined benefit pension plan operated by a reputable insurance

provider. The pension plan is jointly funded by payments from the Credit Union and certain employees,

taking into account the recommendations of independent qualified actuaries. The last full actuarial

valuation of the pension plan for eligible employees was carried out on March 31, 2013.

The amounts recognised in the statement of financial position are determined as follows:

2013

2012

Pension plan assets at fair value

$

6,970,624

6,202,150

Present value of obligation to plan members

(6,648,580) (5,440,540)

322,044

761,610

Unrecognised actuarial losses (gains)

223,765

(378,569)

Asset recognised in the statement of financial position

$

545,809

383,041

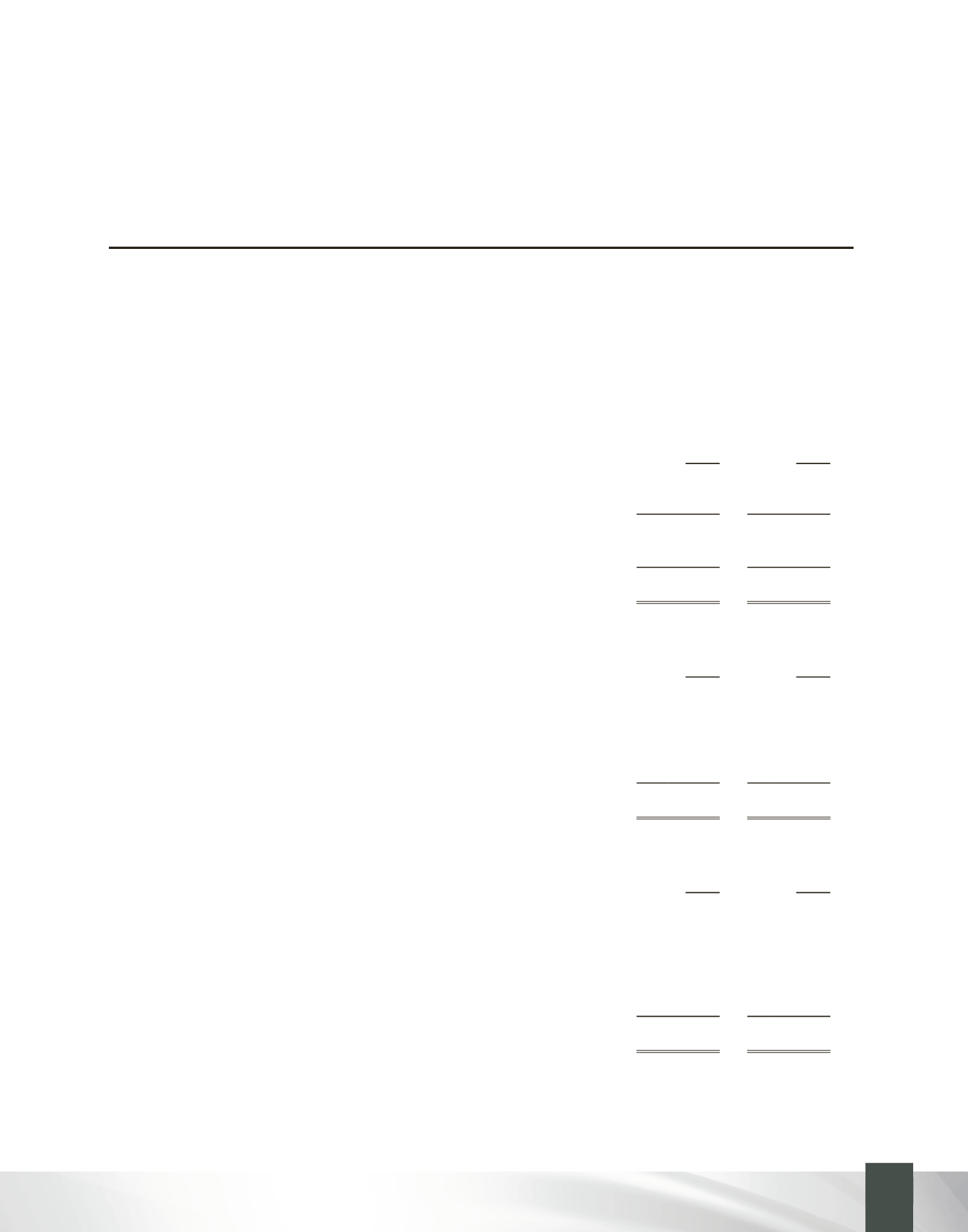

Changes in the fair value of the defined benefit pension plan assets were as follows:

2013

2012

Opening fair value of plan assets

$

6,202,150

5,767,648

Expected return

494,008

465,058

Contributions - total

504,782

512,382

Benefits paid

(160,489)

(46,181)

Actuarial losses

(69,827) (496,757)

Closing fair value of plan assets

$ 6,970,624

6,202,150

Changes in the present value of the obligation for defined benefit pension plans were as follows:

2013

2012

Opening obligation

$

5,440,540

5,400,774

Interest cost

450,859

452,081

Current service cost

460,877

458,728

Past service costs – vested benefits

-

-

Benefits paid

(160,489)

(46,181)

Actuarial losses (gains) on obligation

456,793

(824,862)

Closing obligation

$ 6,648,580

5,440,540

33

BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

ANNUAL REPORT 2013