11

BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

ANNUAL REPORT 2013

Economic review:

During the year under review the Barbados economy recorded

little or no growth due largely to the continuing effects of

the global recession and greater uncertainty in the business

environment. According to recent economic reports, real

output in tourism, manufacturing, construction and agriculture

declined by an average of 3 percent. Output in the non-traded

sectors grew by only 1percent, subdued by the lack of growth

in the tourism sector and reduced spending. Although the rate

of inflation declined, the rate of unemployment increased to

12percent during the year.

Despite these challenges the Barbados economy remained

relatively stable and this resilience was marked by considerable

excess liquidity in the financial sector. Across the financial

sector, financial institutions maintained capital positions well

above the minimum statutory requirements and recorded

improved performances in their operations.

However, the economic slowdown and increasing rate of

unemployment have impacted negatively on credit quality.

As a result there has been a rise in non-performing loans and

increasing rates of loan delinquencies across the financial

sector.

Economic prospects for 2013 and beyond

Continuing instability and uncertainty in the international

environment is expected to impact negatively on prospects for

growth over the next twelve months. Real economic growth

for 2013 is expected to be less than 1percent. Prospects for

improvement will depend largely on raising competitiveness

and lowering inflation through reduction in spending and

wage restraint. Government will need to maintain that delicate

balance between driving productivity and economic recovery

while maintaining a good strong fiscal position.

Consolidated Financial Statement Highlights

MANAGEMENT DISCUSSION AND ANALYSIS

This section of the Group’s Annual Report provides a discussion

and analysis of the financial condition and performance of

the consolidated operations of the Barbados Public Workers’

Co-operative Credit Union Limited and its subsidiaries (“the

Group”) for the financial year ended March 31, 2013.

The Group includes the parent, Barbados Public Workers’ Co-

operative Credit Union Limited (“BPWCCUL”), its subsidiary

BPW Financial Holdings Inc. and its subsidiary CAPITA Financial

Services Inc. (“CAPITA”).

Overview:

In the face of persistent weak economic conditions and an

increasingly competitive environment, the Group maintained

steady growth in loans and deposits and strengthened its

capital and reserve positions through increased earnings results

for the year ended, March 31, 2013. The Group’s performance

was led by BPWCCUL which increased its net surplus by 21.5

percent, but also benefitted from the improved performance

of CAPITA whose net income doubled when compared with

the prior year. These strong results were achieved amidst

a challenging environment characterized by increasing

unemployment, deterioration in credit quality and declining

interest margins. However, the Group has been able to sustain

its growth and profitability levels by closely monitoring credit

risk, effective management of interest rate risks and adopting

a prudent approach to loan loss provisioning. The Group’s

performance has also been helped by the fact that mortgages

represent almost 40 percent of its total loan portfolio, thereby

lowering the risk-weighting of the Group’s asset portfolio.

Notwithstanding these positive developments in the Group,

there are concerns that a protracted slowdown in the

economy together with external factors such as the new

FATCA legislation by USA authorities could have a significant

negative impact on the local financial sector. As a consequence,

there is a renewed emphasis by regulatory and supervisory

bodies to ensure that the financial sector has the capacity to

withstand sizeable shocks and remain resilient to difficulties

in the economic environment. Results of recent stress tests

conducted by regulators confirmed that the financial system

is well capitalized; however, various policy initiatives are being

undertaken by regulators to ensure the continuing stability of

the local financial sector.

Despite the challenges on the horizon, the Group will continue

to ensure that risk exposures are closely monitored and that

the business model across its operations remains viable and

relevant to members and clients through innovative products

and services.

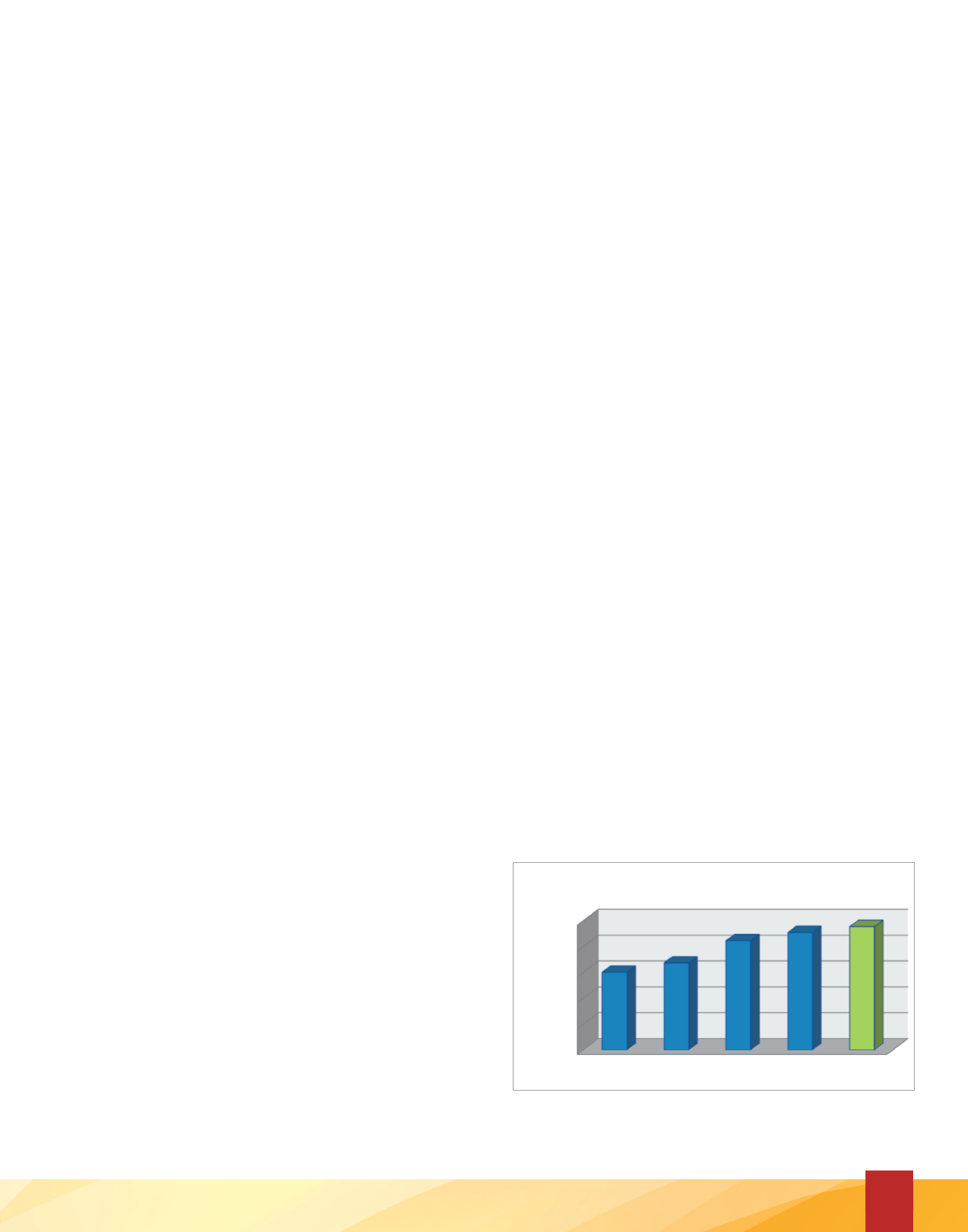

0

200,000

400,000

600,000

800,000

1,000,000

2009

2010

2011

2012

2013

599,364 671,756

842,307 906,186 951,509

In BD$'000

Total assets

13,214

Net Income