BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

NON-CONSOLIDATED ANNUAL REPORT 2015

60

BARBADOS PUBLIC WORKERS' CO-OPERATIVE CREDIT UNION LIMITED

Notes to the Non-consolidated Financial Statements

For the year ended March 31, 2015

(Expressed in Barbados dollars)

49

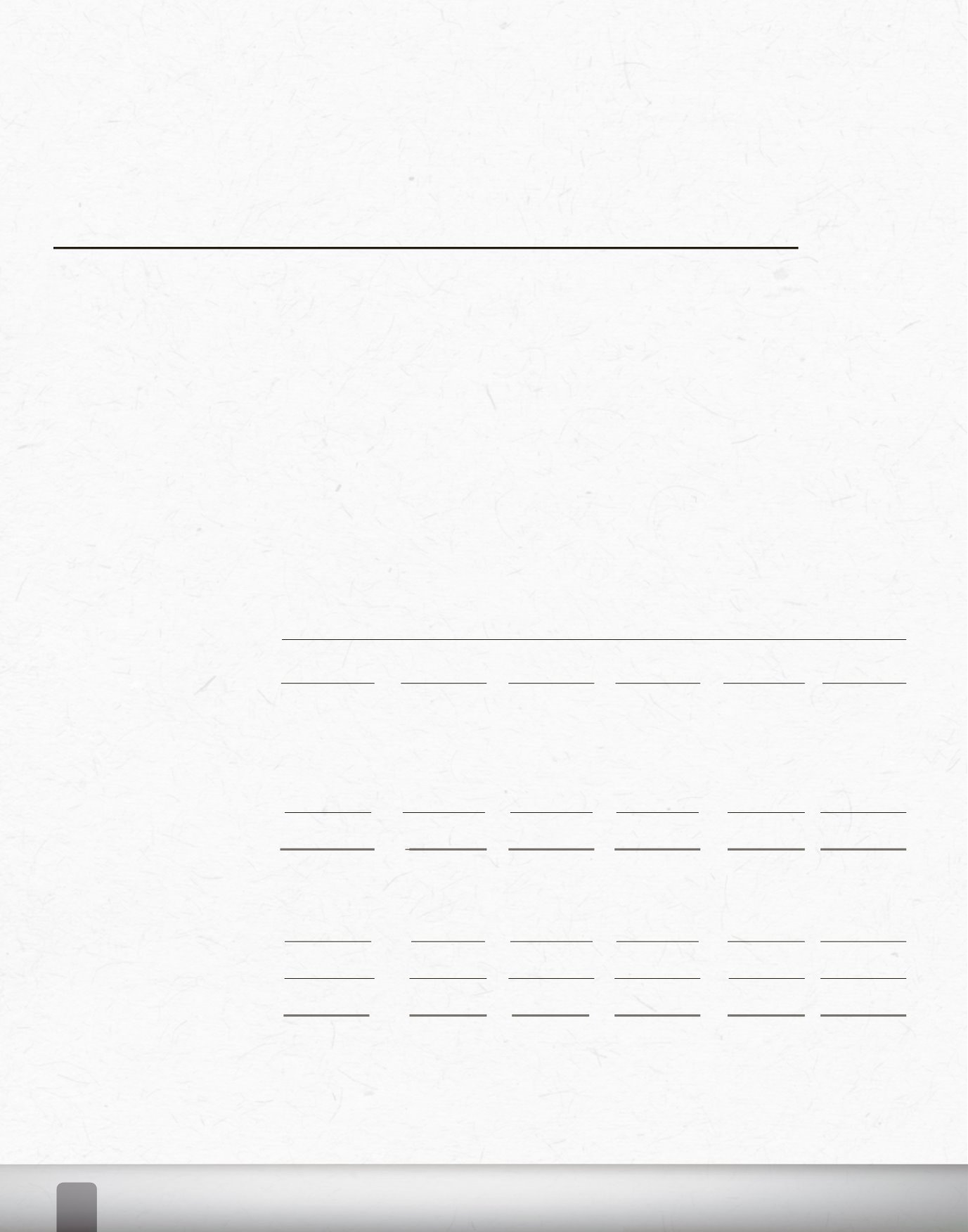

24. Financial Risk Management…(continued)

Market risk

Market risk is the risk that the fair value or future cash flows of financial instruments will fluctuate due to

changes in market variables such as interest rates, foreign exchange rates and equity prices. The Credit

Union is mainly exposed to interest rate risk. The Credit Unionʼs exposure to currency risk is minimal

since it does not have any significant foreign currency denominated assets.

Interest rate risk

Interest rate risk is the risk of loss from the fluctuations in the future cash flows or fair values of financial

instruments because of a change in market interest rates. It arises when there is a mismatch between

interest-bearing assets and interest-bearing liabilities, which are subject to interest rate adjustments,

within a specified period. It can be reflected as a loss of future net interest income and/or a loss of

current market values.

BARBADOS PUBLIC WORKERS' CO-OPERATIVE CREDIT UNION LIMITED

Notes to the Non-consolidated Financial Statements

For the year ended March 31, 2015

(Expressed in Barbados dollars)

50

24. Financial Risk Management…(continued)

Market risk…(continued)

Interest rate risk

…(continued)

A summary of the Credit Unionʼs interest rate gap position is as follows:

2015

Up to

Within

Within

Over

Non-interest

3 months 3-12 months

1-5 years

5 years

bearing

Cash resources

$

48,134,476

29,615,243

16,023,003

-

-

93,

Financial investments – Held-to-maturity

2,082,500

5,646,952

7,109,000

11,000,000

-

25,

Loans and advances

14,231,946

25,200,556 190,162,891 516,901,546

-

746,

Due from related companies

-

-

-

-

17,425,274

17,

Other assets

-

-

-

- 3,937,049

3,

Total assets

$ 64,448,922 60,462,751 213,294,894 527,901,546 21,362,323 887,

Deposits

$ 431,817,993

55,072,201 256,421,519

31,804,572

-

775,

Loans payable

765,343

2,332,256

13,298,434

17,049,099

-

33,

Reimbursable shares

-

-

-

-

6,700,221

6,

Other liabilities

-

-

-

- 7,418,620

7,

Total liabilities

432,583,336 57,404,457 269,719,953 48,853,671 14,118,841 822,

Interest rate gap

$ (368,134,414) 3,058,294 (56,425,059) 479,047,875 7,243,482 64,

2015

Up to

Within

Within

Over Non-interest

3 months 3-12 months 1-5 years 5 years bearing Total

Cash resources

$ 48,134,476 29,615,243 16,023,003

-

-

93,772,722

Financial investments –

Held-to-maturity

2,082,500

5,646,952 7,109,000 11,000,000

-

25,838,462

Loans and advances

14,231,946 25,200,556 190,162,891 516,901,546

-

746,496,939

Due from related companies

-

-

-

-

17,425,274 17,425,274

Other a sets

-

-

-

-

3,937,049 3,937,049

Total a sets

$ 64,448,922 60,462,751 213,294,894 527,901,546 21,362,3 3 887,470,446

Deposit

$ 431,817,993 55,072,201 256,421,519 31,804,572

-

775,116 85

Loans payable

765,343 2,332,256 13,298,434 17,049,099

-

33 45 132

Reimbursable shares

-

-

-

-

6,700,221 6,700,221

Other liabiliti

-

-

-

-

7,418,620 7 4 620

Total liabilities

432,583,336 57,404,457 269,71 ,953 48,853,671 14,11 ,841 822,680,258

Interest rate gap

$ (368,134,414)

3,058,294 (56,425,059) 479,047,875 7,243,482 64,790,188