63

BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

NON-CONSOLIDATED ANNUAL REPORT 2014

BARBADOS PUBLIC WORKERS' CO-OPERATIVE CREDIT UNION LIMITED

Notes to the Non-consolidated Financial Statements

For the year ended March 31, 2014

(Expressed in Barbados dollars)

54

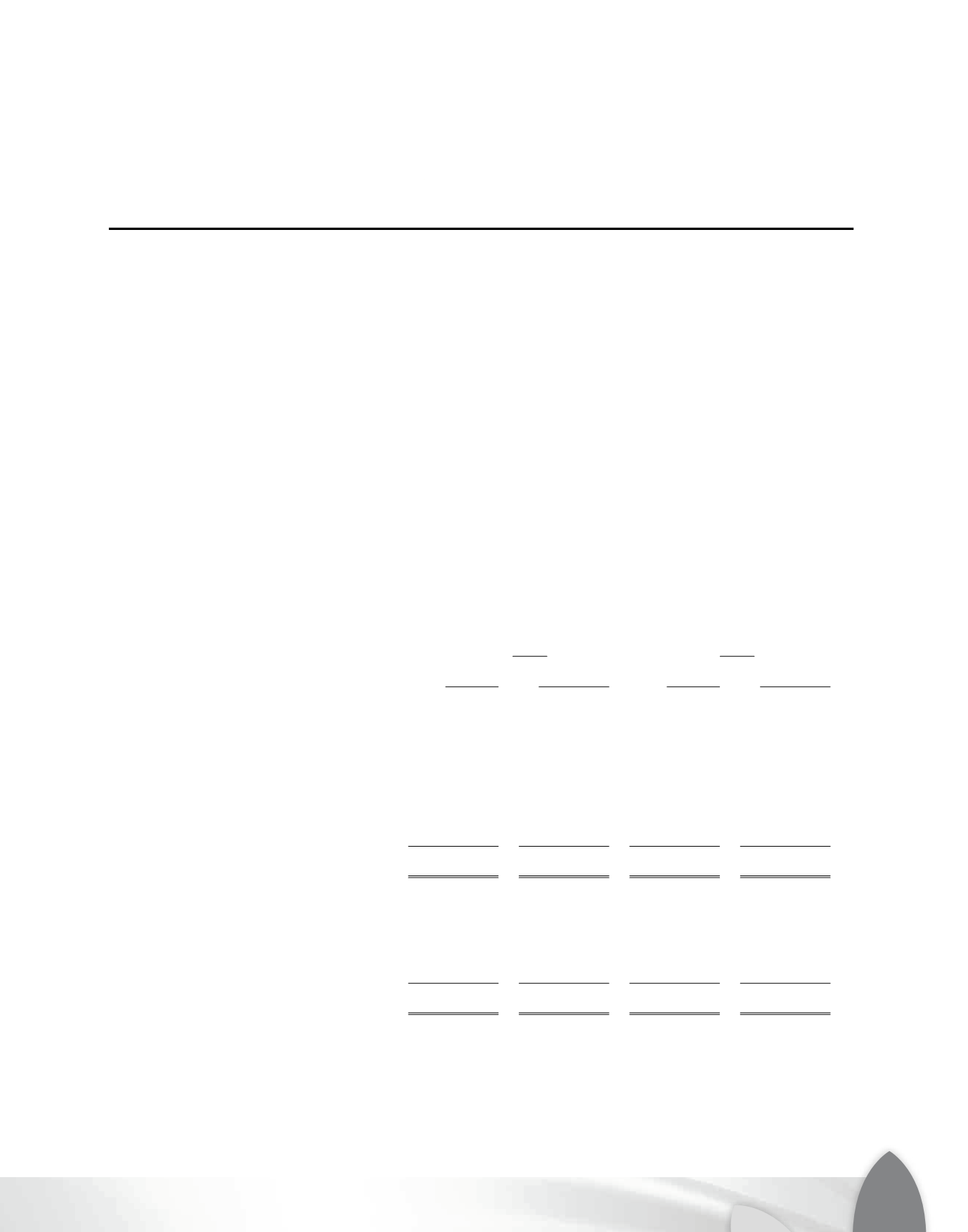

24. Fair Value

Fair value represents the price that would be received to sell an asset or paid to transfer a liability in an

orderly transaction between market participants at the measurement date and is best evidenced by a

quoted market price, if one exists.

Financial assets and liabilities are carried at amounts, which approximate to their fair value at the

statement of financial position date. Fair value estimates are made at a specific point in time, based on

market conditions and information about the financial instrument.

These estimates are subjective in nature and involve uncertainties and matters of significant judgment

and therefore, cannot be determined with precision. Changes in assumptions could significantly affect

the estimates.

For financial assets and financial liabilities that are liquid or have short term maturity, it is assumed that

the carrying amounts approximate their fair value. These include cash resources, other assets and

other liabilities. The fair value of debt securities is based on quoted prices where available, or

otherwise based on an appropriate yield curve with the same remaining term to maturity. The fair value

of loans and advances largely approximates carrying value as the Credit Union's portfolio comprises

mainly variable rate loans. The fair value of deposits takes account of certain fixed rate deposits which

have been discounted at current interest rates.

The fair values of financial assets and liabilities, together with the carrying amounts shown in the

statement of financial position are shown in the table below:

2014

2013

Carrying

Carrying

Amount

Fair Value

Amount

Fair Value

Assets

Cash resources

$ 109,228,502 109,228,502 110,240,420 110,240,420

Financial investments

– Held to maturity

20,395,633

20,395,633

16,377,955

16,377,955

– Available-for-sale

1,954,348

1,954,348

1,854,710

1,854,710

Loans and advances

684,331,479 684,331,479 651,867,950 651,867,950

Due from related companies

17,107,462

17,107,462

13,034,575

13,034,575

Other assets

3,124,648 3,124,648 2,933,768 2,933,768

$ 836,142,072 836,142,072 796,309,378 796,309,378

Liabilities

Deposits

$ 721,766,830 793,136,109 672,403,345 733,106,794

Loans payable

43,688,473

43,688,473

55,432,374

55,432,374

Reimbursable shares

5,351,432

5,351,432

5,726,048

5,726,048

Other liabilities

7,967,387 7,967,387 4,215,566 4,215,566

$ 778,774,122 850,143,401 737,777,333 798,480,782