BARBADOS PUBLIC WORKERS' CO-OPERATIVE CREDIT UNION LIMITED

Notes to the Non-consolidated Financial Statements

For the year ended March 31, 2013

(Expressed in Barbados dollars)

39

24. Financial Risk Management…(continued)

Credit risk…(continued)

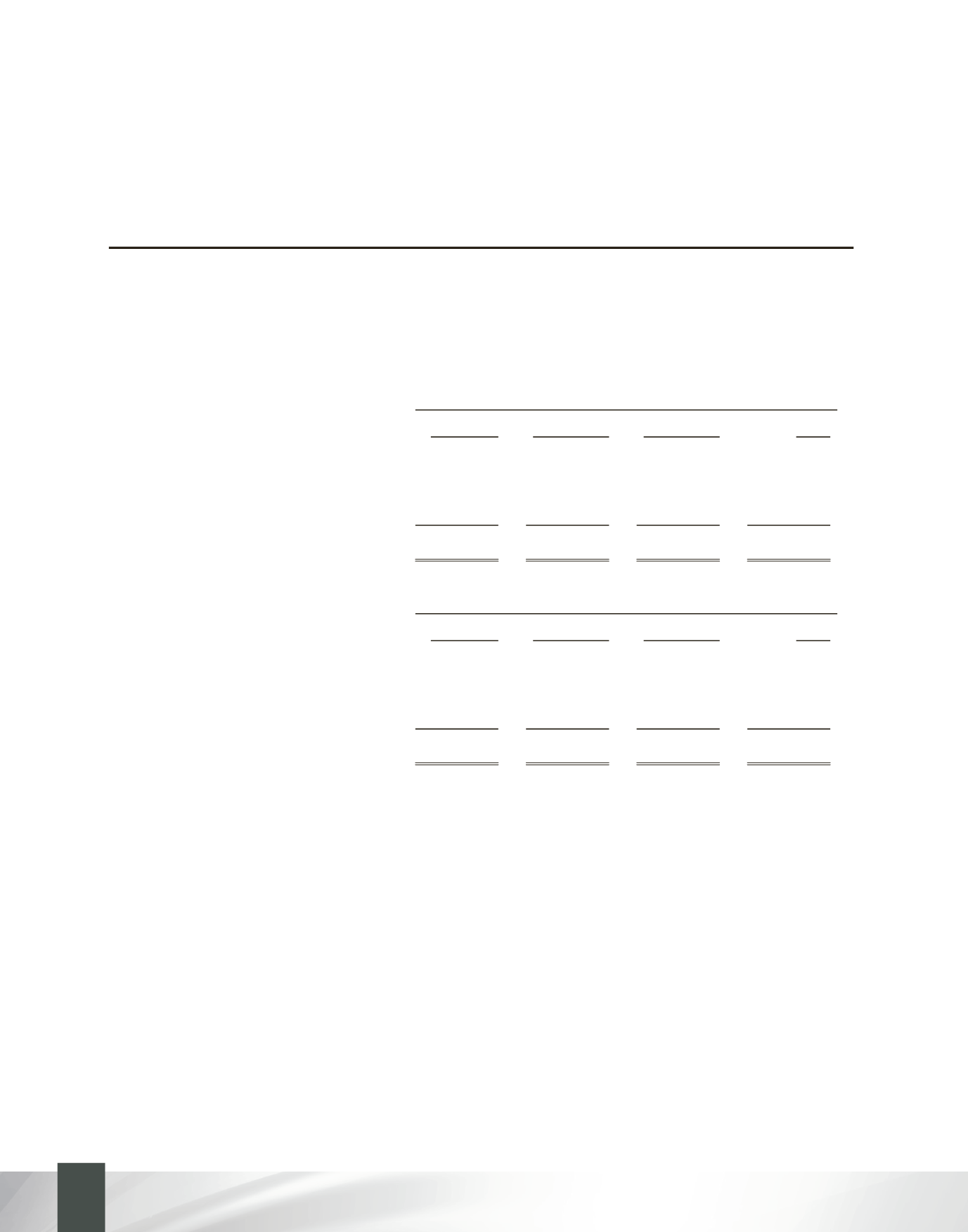

Aging analysis of past due but not impaired loans and advances:

2013

1-30 days

31-60 days

61-90 days

Total

Loans and advances:

Consumer

$ 46,331,063

11,185,911

4,120,175

61,637,149

Mortgages

22,771,341

6,774,495

3,563,579

33,109,415

Business

243,939

334,209

594,457

1,172,605

Total

$ 69,346,343

18,294,615

8,278,211

95,919,169

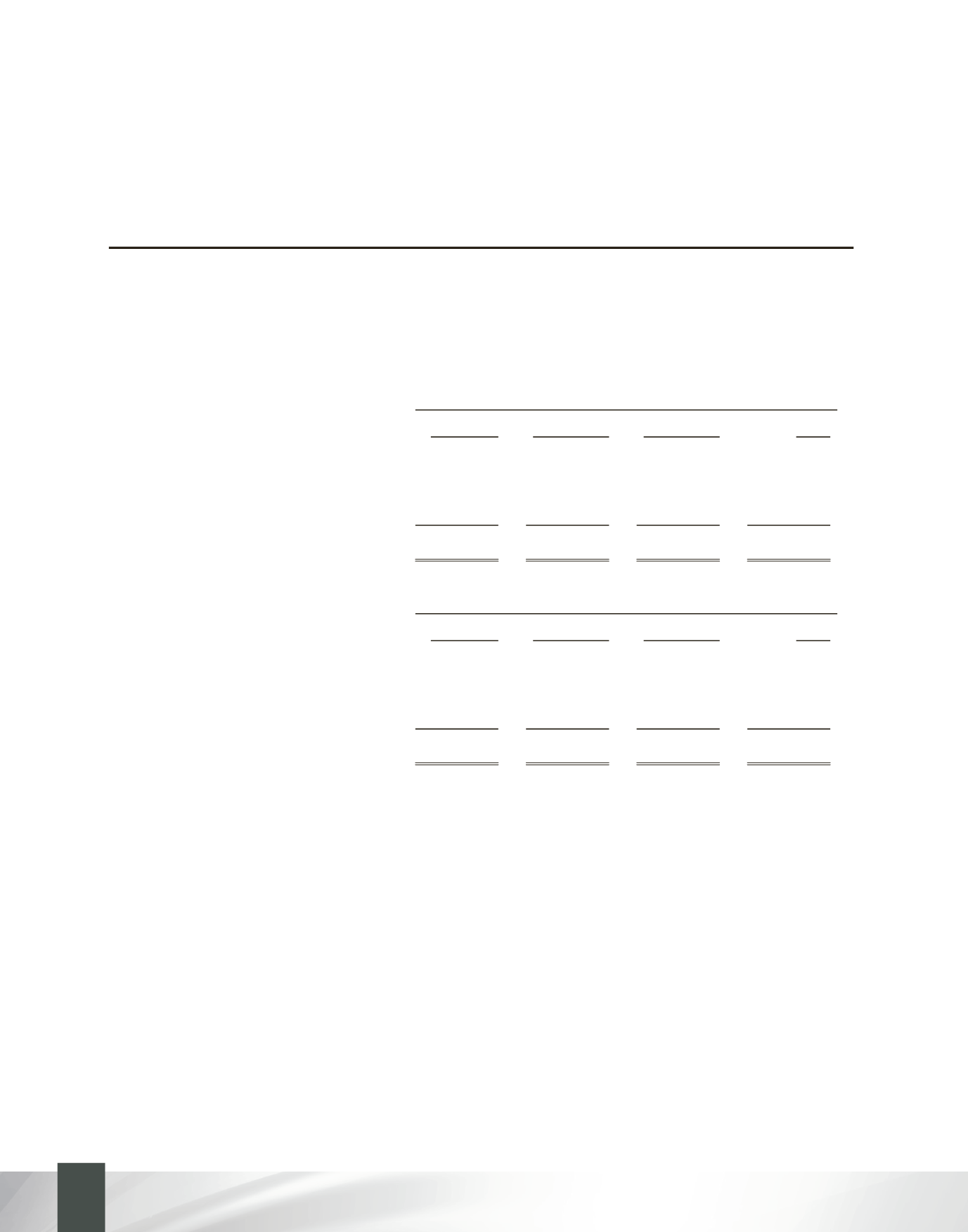

2012

1-30 days

31-60 days

61-90 days

Total

Loans and advances:

Consumer

$ 40,878,208

12,000,025

3,704,532

56,582,765

Mortgages

21,537,540

5,368,400

1,084,030

27,989,970

Business

913,394

185,871

133,883

1,233,148

Total

$ 63,329,142

17,554,296

4,922,445

85,805,883

Impairment assessment

For accounting purposes, the Credit Union uses an incurred loss model for the recognition of losses on

impaired financial assets. This means that losses can only be recognised when objective evidence of a

specific loss event has been observed. Triggering events include the following:

-

Significant financial difficulty of the customer.

-

A breach of contract such as a default of payment.

-

Where the Credit Union grants the customer a concession due to the customer experiencing

financial difficulty.

-

It becomes probable that the customer will enter bankruptcy or other financial

reorganisation.

-

Observable data that suggests that there is a decrease in the estimated future cash flows

from the loans.

48

BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

ANNUAL REPORT 2013