9

BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

ANNUAL REPORT 2013

AMORTIZATION OF DEFERRED EXPENSES

A noticeable decrease was seen in the amortization of deferred

expenses, these amounts represent research and development

expenditure incurred in the implementation of new and

automated services and was previously amortized over a three

year period.

In 2012 cumulative amounts from previous years were written

off with respect to amortization of deferred expenses which

totaled $1.3 million. These amounts are now expensed as

incurred; the amounts incurred and expensed in 2013 were

$180 thousand.

OPERATING LEASES

Rent expenses showed a steep increase for the 2013 income

year moving from $22 thousand in 2012 to $172 thousand in

2013. This increase was directly attributed to expansions of the

Credit Union’s branch operations at the Six Roads location as

well as the establishment of a new branch at Carlton & A1 in

Black Rock St. Michael.

STAFF COSTS

During the year, the Credit Union increased its staff complement

to strengthen its member services, financial reporting and risk

management functions as well as providing human resources

for its branch expansions. In addition, contractual salary

increases as well as higher pension plan expenses contributed

to the increase in staff costs.

TOTAL EXPENSES

Total expenses for the year under review amounted to $27.2

million, which represents a decrease of $859 thousand or

3.1 percent below the $28.1 million incurred during the

corresponding period last year.

Significantly contributing to the decrease were reductions in

other operating expenses of $1.5 million. Amortization of

deferred expenses decreased by $1.1 million while advertising

decreased by $300 thousand. However, staff costs and

depreciation increased by $518 thousand and $78 thousand

respectively.

NET OPERATING INCOME

Net operating income inclusive of loan impairment expenses

increased by $1.3 million or 3.4 percent, to end the year at

$39.3 million. Loan impairment expense was $4.8 million, up

from $3.9 million one year earlier.

The increase of $0.9 million reflects primarily the increase in the

consumer loan delinquency ratio which grew from 6.7 percent

in the prior year to 7.1 percent during the period under review.

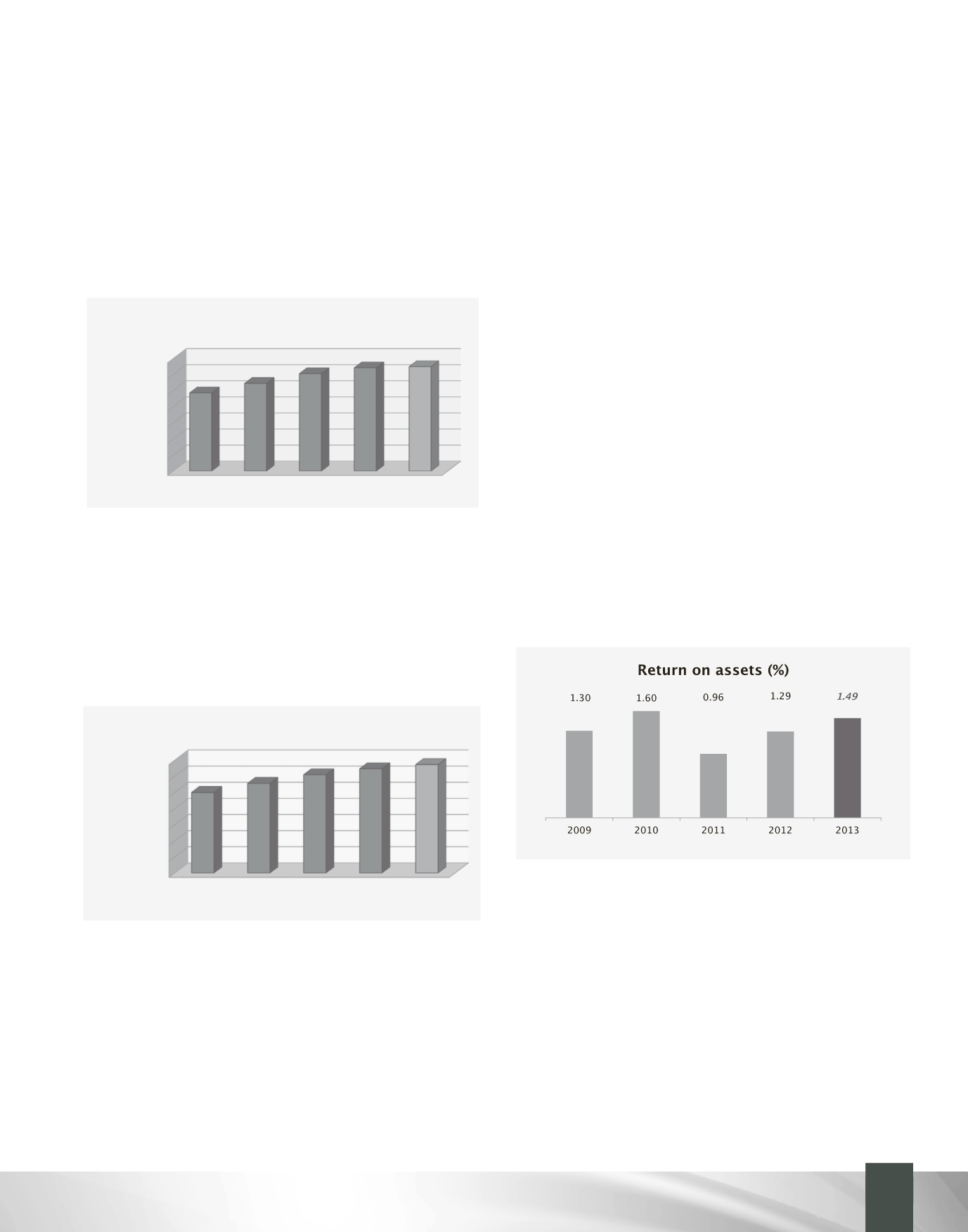

ASSETS

At year-end the Credit Union’s asset base amounted to $827.1

million, an increase of $35.6 million or 4.5 percent. During the

year cash and cash equivalents increased by $17.9 million or

64.0 percent. In addition, financial investments classified as

held-to-maturity increased by $5.1 million or 44.7 percent.

At the end of the financial year, the net loans and advances

rose to $651.9 million, inclusive of impairment provision of

$19.6 million, as compared to $642.8 million and $16.6 million

respectively at the end of the previous year. Consumer loans

were the major engine of loan growth during the year.

ASSET QUALITY

Amid a backdrop of a prolonged recessionary period, the Credit

Union recorded an increase of seventy-five basis points in its

delinquency ratio which ended the year at 7.65 percent. The

increase was felt predominantly in the consumer segment of

the loan portfolio.

0

100,000

200,000

300,000

400,000

500,000

600,000

700,000

2009

2010

2011

2012

2013

486,712

545,488

606,515 642,797 651,868

In BD$'000

Loans and advances

0

100,000

200,000

300,000

400,000

500,000

600,000

700,000

2009

2010

2011

2012

2013

499,745

556,123

609,705 646,435 672,403

In BD$'000

Deposits

0

1 ,000

200,000

300,000

400,000

500,000

600,000

700,000

2009

2010

2011

2012

2013

486,712

545,488

606,515 642,797 651,868

In BD$'000

Loans and advances

0

100,000

200,000

300,000

400,000

500,000

600,000

700,000

2009

2010

2011

2012

2013

499,745

556,123

609,705 646,435 672,403

In BD$'000

Deposits