31

BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

ANNUAL REPORT 2013

Notes to the Consolidated Financial Statements

For the year ended March 31, 2013, with comparative figures for 2012

(Expressed in Barbados dollars)

The deferred tax liability consists of accelerated tax depreciation. The deferred tax asset not recognised comprises losses and

accelerated tax depreciation of the St. Lucia Branch of a subsidiary.

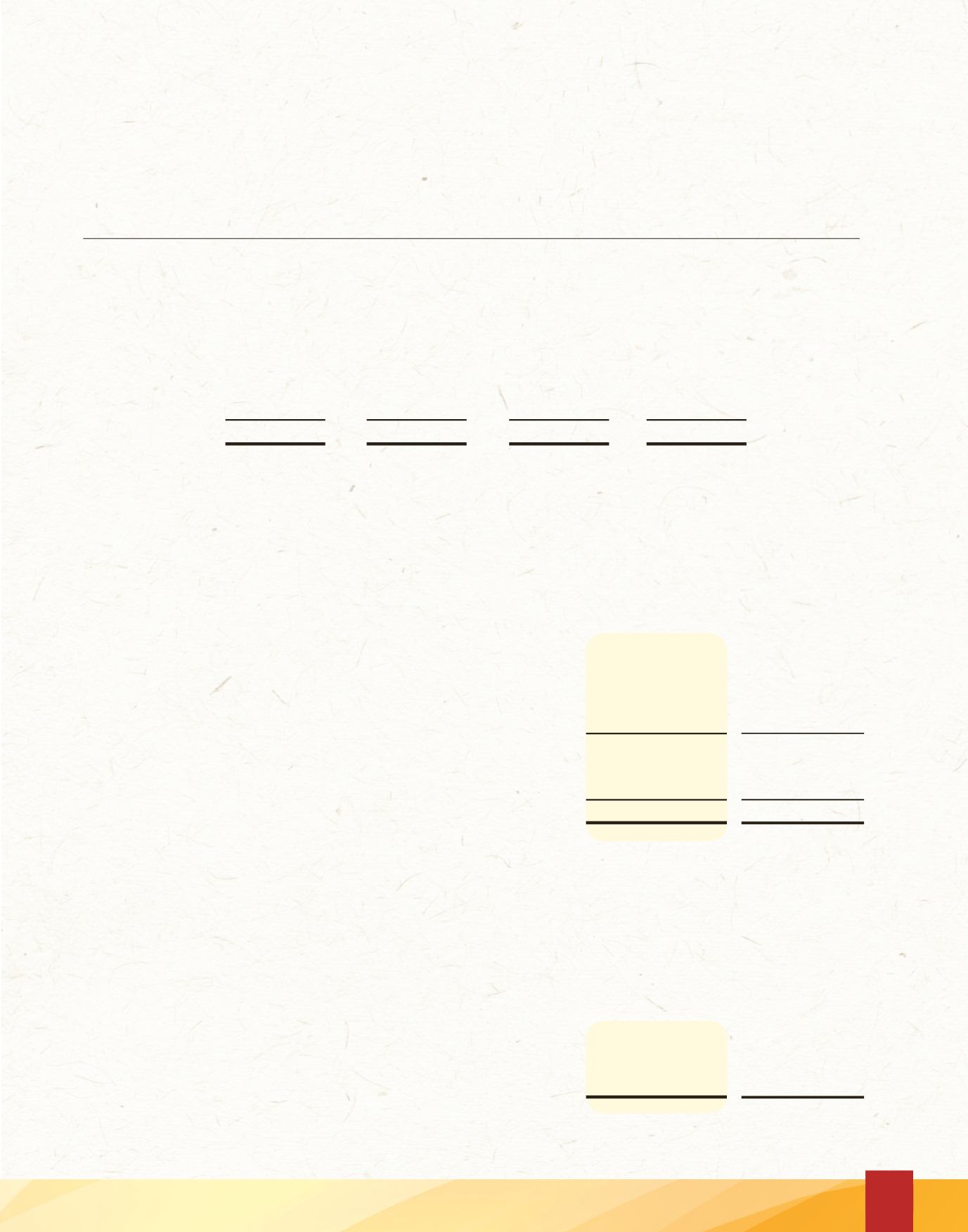

The accumulated losses for tax purposes which may be carried forward and set off against future taxable income as follows:

Losses

Losses

Expiry

Year of loss

b/fwd

Incurred

Expired

c/fwd

Date

2007

$ 366,947

-

366,947

-

2013

2008

234,314

-

-

234,314

2014

2009

97,384

-

-

97,384

2015

2010

44,017

-

-

44,017

2016

2011

57,777

-

-

57,777

2017

2012

205,852

-

-

205,852

2018

2013

-

52,368

-

52,368

2019

$ 1,006,291

52,368

366,947

691,712

These losses are as computed by the subsidiary in its corporation tax returns and have as yet neither been confirmed nor disputed by

the Commissioner of Inland Revenue.

8. DISTRIBUTIONS TO MEMBERS

Distributions to members include a dividend of $0.244 (2012: $0.238) per share amounting to $355,499 (2012 - $335,281) and

interest rebate amounting to $1,187,520 (2012 - $1,079,327).

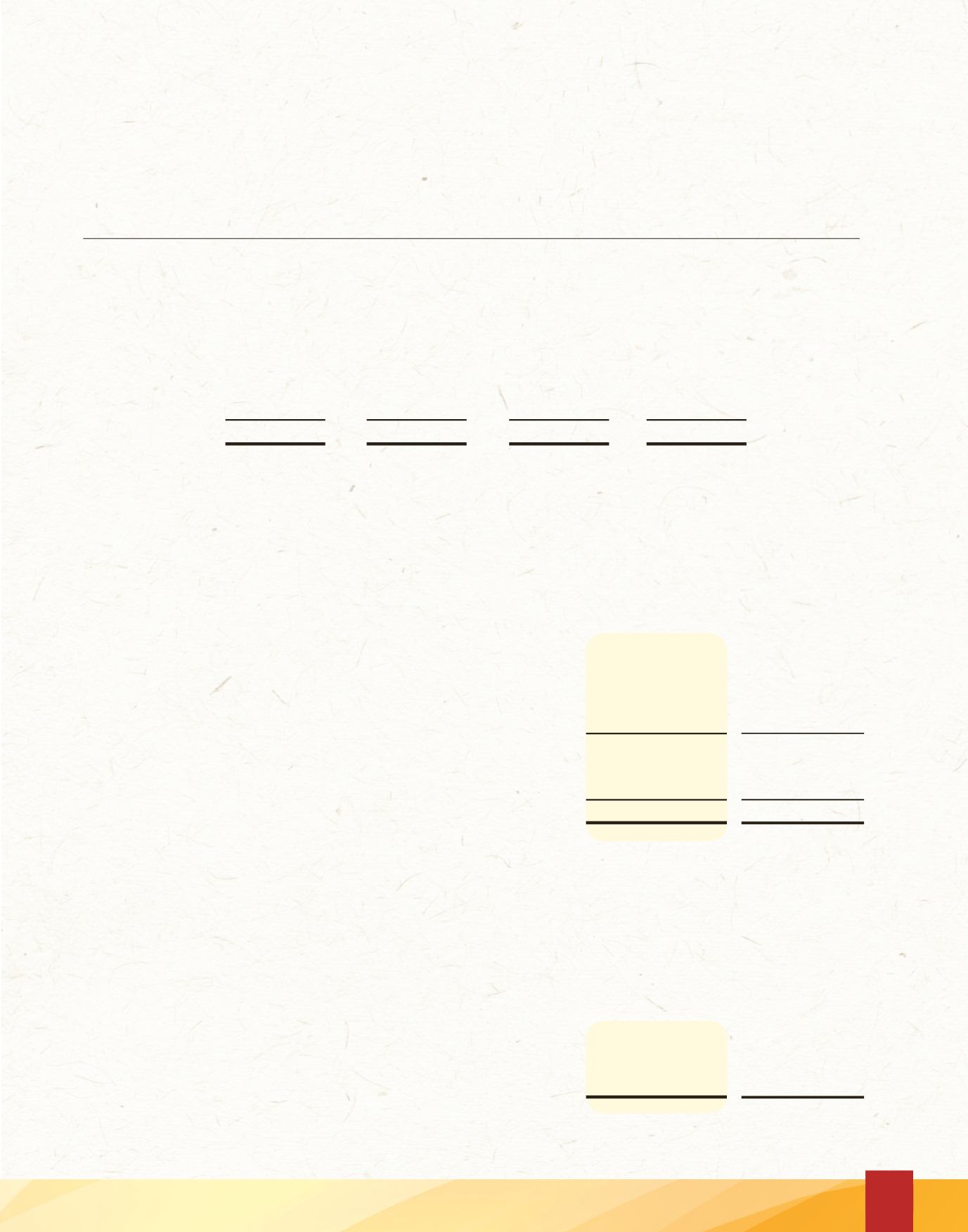

9. CASH RESOURCES

2013

2012

Cash

$ 19,853,505

25,897,867

Short-term deposits

45,283,952

23,317,308

Cash balances maturing within 90 days

65,137,457

49,215,175

Other term deposits

48,920,167

50,559,954

Mandatory reserve deposits with Central Bank of Barbados

3,375,829

3,125,829

Total cash resources

$ 117,433,453

102,900,958

Term deposits amounting to $5,000,000 (2012 - $5,000,000) were pledged as security for a line of credit facility with a commercial

bank.

Mandatory reserve deposits with the Central Bank are non-interest bearing and represent a subsidiary’s regulatory requirement to

maintain a percentage of deposit liabilities as cash or deposits with the Central Bank. These non-interest bearing funds are not

available to finance day-to-day operations and as such, are excluded from cash resources to arrive at cash and cash equivalents for

the purpose of the statement of cash flows.

At March 31, 2013, cash resources with the exception of mandatory reserve deposits with Central Bank carry interest rates varying

from 0.50% to 1% per annum (2012 - 0.50% to 1%).

For the purposes of the cash flow statements, cash and cash equivalents comprise:

2013

2012

Cash balances maturing within 90 days

$ 65,137,457

49,215,175